A Sleepless Malice: Dance of Geopolitics and Business Supremacy #405

The Great Depression of the 1930s led to World War 2 in a significant manner. Current economic crises and geopolitical battles are converging. What will the coming wars be like? We look at the scenario deeply.

Slow is its gait. And stealth its manner.

The oncoming danger is not always accompanied by warning signs. Ask the festival attendees from Israel.

A war that is fought with known weapons may be predicted based on weapon's supremacy. But a war that is waged from within the adversary's territory is a very difficult one to predict or estimate.

And, that is the key right now.

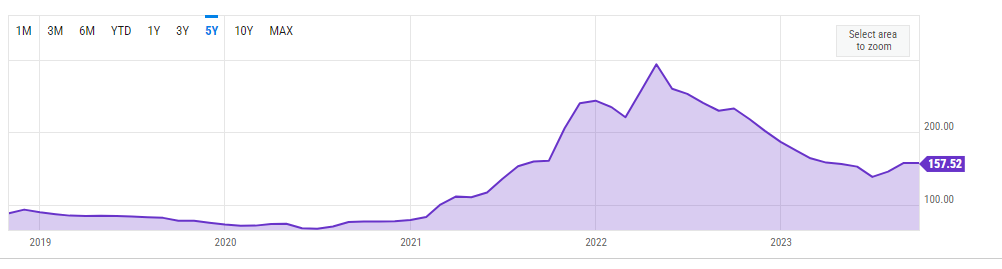

The world of business and economies around the world are trying to tip-toe around a recession with a large global debt crisis looming in almost every country. Options are few and limited.

They become harder when global supply chains are being targeted and reconfigured.

Business cycles in the coming months will change. Alliances will break and reform with new participants.

A new world order is emerging. But order will be on the other side of unprecedented and unseen chaos and bloodshed.

Next World War, may not be fought between nations.

But on the streets of targeted nations.

Assessing the Economic Situation

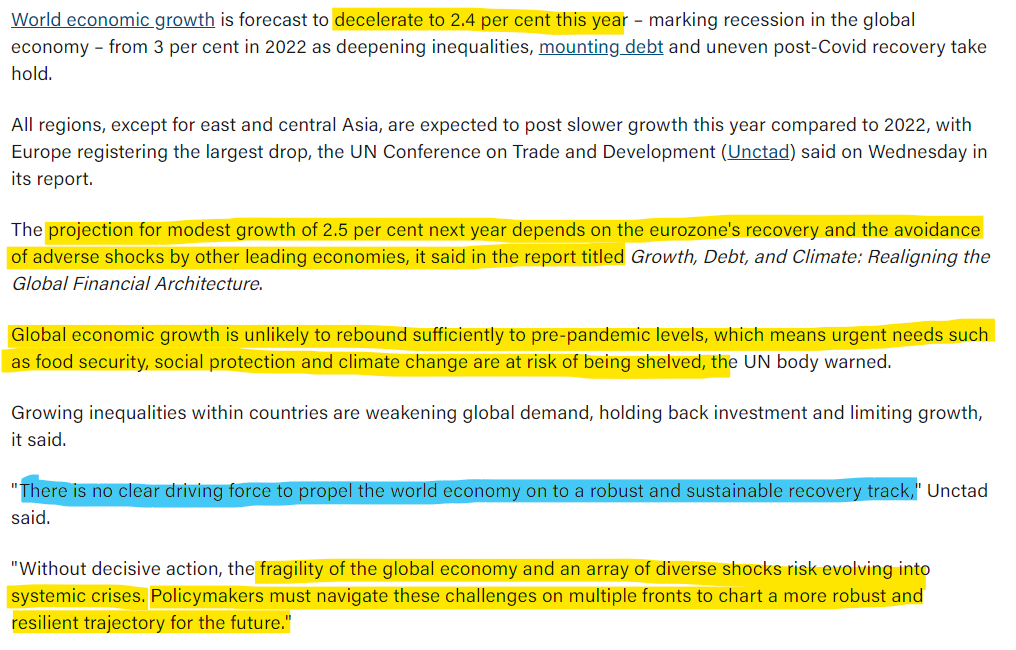

Currently, the world economy is headed for a deceleration. Europe and US are slowing down the most, while Asia may see a healthier situation.

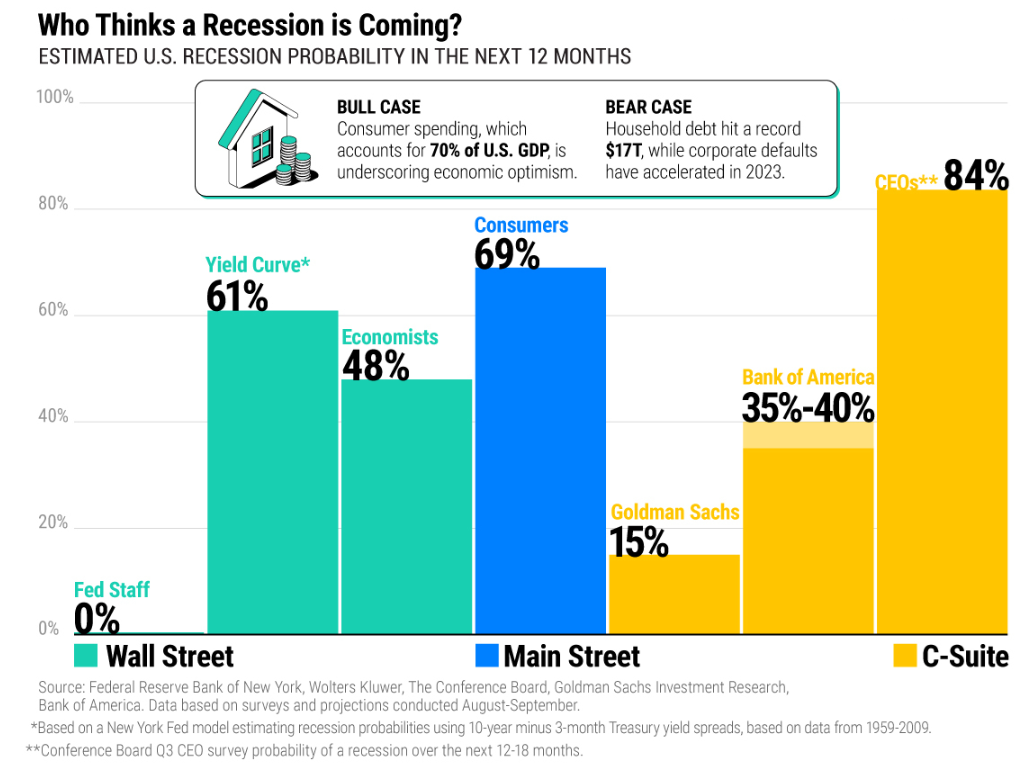

The Consumers and the CEOs believe that a recession is imminent in 2024.

At this time, the global debt levels have reached record levels. The debt has surged by $100 trillion in just the last decade.

Global debt has surged by approximately $100 trillion in the past decade. In the second quarter of 2023, global debt reached a record-breaking $307 trillion. The global debt-to-GDP ratio has climbed for two consecutive quarters, now standing at 336%. And what has caused all this?

- Bank bailouts

- Slow economic growth

- Budget deficits

- COVID-19

- Increased interest rates

What does this mean? We are looking at the 2008 type of economic recessionary situation where a credit crunch would result from a tightening monetary policy.

Central banks around the world have been hiking interest rates for over a year in a bid to rein in sky-high inflation. The U.S. Federal Reserve earlier this month lifted its fed funds rate to a target range of 5%-5.25%, the highest since August 2007. "With financial conditions at their most restrictive levels since the 2008-09 financial crisis, a credit crunch would prompt higher default rates and result in more 'zombie firms' — already approaching an estimated 14% of U.S.-listed firms," the IIF said in its quarterly Global Debt Monitor report late Wednesday. (Source: Global debt nears record highs as rate hikes trigger 'crisis of adaptation,' top trade body says / CNBC)

This is sobering - 14% of the currently listed firms in the US are "zombie companies".

Growth in such companies means that there is very little investment in future growth happening, at least in the US economy.

While the world is seeing a recessionary global economy, the Chinese economic performance this quarter was healthy.

China’s third-quarter economic growth came in stronger than expected, boosting hopes that the world’s second-largest economy will meet or even exceed Beijing’s target for about 5% this year. Economic activity has shown signs of stabilization in recent data. On Wednesday, September data for retail sales and industrial production also bested median forecasts, with the cumulative fixed asset investment print for the first nine months this year slightly below expectations. (Source: China’s third-quarter growth exceeds forecast, consumer spending and industrial production offer hope / CNBC)

Even though this quarter was good, the IMF warned of a slowdown in China like that in Japan in the 1990s. They are calling it Japanisation.

China’s real estate market is in decline. Debt deflation hangs in the air. The country’s workforce is shrinking and GDP growth is trending downwards. No wonder the International Monetary Fund at its recent shindig in Marrakech warned of slowing economic growth in the People’s Republic, raising the prospect of “Japanisation” – the prolonged economic and financial malaise that afflicted its once high-flying neighbour after an asset bubble imploded three decades ago. The trouble is that China’s economic imbalances are far worse than Japan’s in 1990. And that’s before considering the ruinous economic consequences of President Xi Jinping’s autocratic rule. (Source: China’s leaders speed towards Japanisation / Reuters)

Now, all this is the evaluation of the global economy if there was no other factor bearing upon it.

Global Trade and Security Battles - Chips and Batteries

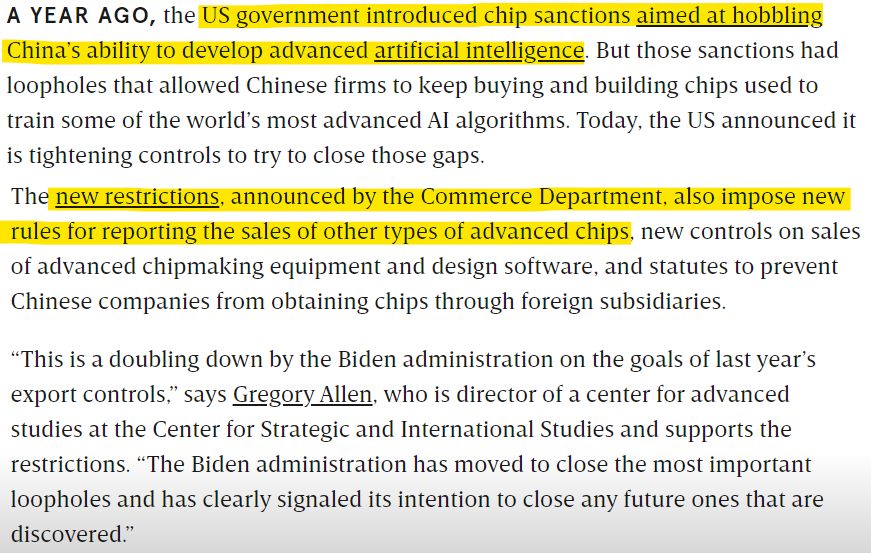

There is a battle ensuing between the US and China. It started a year back when suddenly the US Government's sanctions via the United States Bureau of Industry and Security put export controls that basically was a declaration of economic war on China.

With the Oct. 7 export controls, the United States government announced its intent to cripple China’s ability to produce, or even purchase, the highest-end chips. The logic of the measure was straightforward: Advanced chips, and the supercomputers and A.I. systems they power, enable the production of new weapons and surveillance apparatuses. (Source: ‘An Act of War’: Inside America’s Silicon Blockade Against China / New York Times)

That was followed in August with a ban on "covered national security technologies and products". Which areas were these?

The "semiconductors and microelectronics, quantum information technologies, and artificial intelligence sectors that are critical for the military, intelligence, surveillance, or cyber-enabled capabilities of a country of concern." (Source: Executive Order on Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern / White House)

Basically, the US government was banning products in semiconductors, quantum tech, and AI technologies to go to China.

The new rules now - released on October 17th - go a step further. They impose restrictions on China acquiring these chips via any foreign subsidiaries. (Source: BIS Export Controls/Oct 17, 2023).

The Chinese government is hitting back in its own ways. China is the world's top graphite producer and it has put restrictions on the export of graphite. Graphite is used in all EV batteries.

China said on Friday it will require export permits for some graphite products to protect national security, springing a surprise with another bid to control critical mineral supply in response to challenges over its global manufacturing dominance. China is the world's top graphite producer and exporter. It also refines more than 90% of the world's graphite into the material that is used in virtually all EV battery anodes, which is the negatively charged portion of a battery. (Source: "China, world's top graphite producer, tightens exports of key battery material" / Reuters)

Not just the graphite, but Beijing has gone ahead to enforce export controls for Gallium and Germanium - two rare elements that are essential for manufacturing semiconductors.

Beijing will impose export controls on two rare elements essential for manufacturing semiconductors, in apparent retaliation after the United States and Europe restricted chip exports to China. Gallium and germanium will be subject to export controls starting August 1 “to protect national security and interests,” China’s Ministry of Commerce said in a statement Monday. Exporters of these raw materials will need to apply for “special permission from the state” to ship them out the country, the statement said. (Source: "China hits back in the chip war, imposing export curbs on crucial raw materials" / CNN/Jule 3, 2023)

The President of South Korea, Yoon Suk Yeol, summed up the situation in the best way.

“Geopolitical issues have become the biggest risk for companies to manage,” South Korea’s president, Yoon Suk Yeol, said in June, speaking at a meeting of government officials and business executives about a national semiconductor strategy. “Companies cannot resolve this problem alone,” he said, calling the competition over chips an “all-out war.” (Source: What the U.S.-China Chip War Means for a Critical American Ally / New York Times)

The Competition over chips - technology and raw materials - is an all-out war!

And, business competition variables aren't the only ones impacting corporate decisions. Geopolitics is now a major factor!

This is something that makes you wonder. You see, World War II was not caused by geopolitical factors alone. The Great Depression of the 1930s set off a series of events that finally resulted in a geopolitical quagmire, where Germany did what it did and set off the reaction to create a World War.

The economic troubles of the 1930s were worldwide in scope and effect. Economic instability led to political instability in many parts of the world. Political chaos, in turn, gave rise to dictatorial regimes such as Adolf Hitler's in Germany and the military's in Japan. (Totalitarian regimes in the Soviet Union and Italy predated the depression.) These regimes pushed the world ever-closer to war in the 1930s. When world war finally broke out in both Europe and Asia, the United States tried to avoid being drawn into the conflict. But so powerful and influential a nation as the United States could scarcely avoid involvement for long. When Japan attacked the U.S. Naval base at Pearl Harbor, Hawaii, on December 7, 1941, the United States found itself in the war it had sought to avoid for more than two years. Mobilizing the economy for world war finally cured the depression. Millions of men and women joined the armed forces, and even larger numbers went to work in well-paying defense jobs. World War Two affected the world and the United States profoundly; it continues to influence us even today. (Source: "U.S. History Primary Source Timeline" / US Library of Congress)

It is never just one set of factors that lead to global upheavals. And, in the last 3 years, we have now had three major ones. COVID Global Pandemic, Ukraine (NATO)-Russia (China) war, and now the Hamas attack on Israel and the Israeli counter.

Economic Impact of Geopolitics

Let us start with the latest.

Hamas' attack and the ensuing situation in Israel have already created a major fertilizer crisis. The prices of fertilizers peaked after the Ukraine war started in February 2022.

The prices have been falling since late 2022. The main reason was a clause in sanctions on Russia/Belarus to avoid the export of raw materials needed for fertilizers. The impact of war was lessened.

There are various reasons for this sharp decline. Chief among them is that raw material inputs – including natural gas, urea, and ammonia – are considerably cheaper. We discuss the role and global marketplace for fertilizer and related raw materials in detail below. Another lesser-known factor is that Western countries did not outright sanction Russian or Belarussian agricultural products, so they have continued exporting fertilizers over the past year (albeit with more difficulty due to sanctions on financial transactions and access to transportation facilities). For example, Lithuania banned rail shipments of Belarussian potash to the European Union. (Source: "Fertilizer Prices in 2023: Why Are They Falling? How Do They Affect Food Markets?" / Macrohive)

The war scenario in Israel has however created a shortage of potash due to restrictions at the Israeli port of Ashdod.

Remember the Ashdod port accounts for ~3% of the global potash supply, and the disruptions there have pushed the Indian fertilizer stocks up by a whopping 40% in the last two weeks. (GSFC, GNFC to FACT: How Israel-Hamas war is fueling fertilizer stocks in India — explained / Live Mint)

Israel is a small country, but the war there will have larger repercussions for many businesses.

The already difficult situation for the chip industry will exacerbate because of the role that Israel plays in the overall global chip supply chain.

Companies like Intel, Qualcomm, Marvell, Mellanox (Nvidia), Annapurna Labs (now Amazon), and many others have chip design and manufacturing centers in Israel. (Source: Israeli Semiconductor Companies)

Just Intel employs 12,800 people in Israel for products that go into AI and self-driving cars. After the Hamas attack on Israel, there has been a mass call-up of army reservists in Israel. That is disrupting businesses and industries including the Chip industry.

The world will likely see a deeper impact of this attack and the escalation that is on the cards now. With Iran getting sucked in, which is what Israel would ideally like, and what Hezbollah's entry may entail in the end, the impact on the global economy would be significant.

Like Middle East wars of the past, the conflict between Israel and Hamas that broke out this past week has the potential to disrupt the world economy — and even tip it into recession if more countries are drawn in. That risk is real, as Israel’s army prepares to invade Gaza in response to an attack by the militant group. The death toll from the Hamas assault and the ongoing Israeli air strikes on Gaza is already in the thousands. There’s concern that militias in Lebanon and Syria that support Hamas will join the fighting. A sharper escalation could bring Israel into direct conflict with Iran, a supplier of arms and money to Hamas, which the US and the European Union have designated a terrorist group. In that scenario, Bloomberg Economics estimates oil prices could soar to $150 a barrel and global growth drop to 1.7% — a recession that takes about $1 trillion off world output. (Source: Wider War in Middle East Could Tip the World Economy Into Recession / Bloomberg)

The Hamas attack was not in isolation.

It was an attack where the intelligence component was very sophisticated and arms used were very extensive.

China's role in Hamas attacks

Already, there is information coming that the steel casings and pipes for the Hamas rockets came from China.

Right, coming from the guy who said “There’s a level of admiration I actually have for China. Their basic dictatorship is actually allowing them to turn their economy around on a dime.”

— Dean Baxendale (@DMCBaxendale) October 20, 2023

Hamas a proxy for China

Aparatly steel casings for the rockets were sold by a Chinese company https://t.co/KHCyK3oGD9 pic.twitter.com/4OQYzPIU8v

That is not a shocker because, in March 2021, Iran and China signed a deal for military cooperation, with joint training, research, and intelligence sharing. The relationship between Iran and Hamas creates a link between this deal and the Hamas's actions in Israel.

The fact is that the attacks by Hamas were backed by a level of intelligence that a terrorist organization does not possess on its own.

Some are already broadly suggesting that the source was China.

And, this is important to understand.

Because China may just be getting started here.

This is a small clip from the YouTube channel Lei's Real Talk. It is worth watching. The guy who is speaking is a top journalist/blogger on Chinese politics. He does not live in China anymore but has interesting insights.

- Hamas's attack is just the beginning.

- China wants to create chaos and then use that.

- China may start a major conflict in the Asia Pacific.

- He says that China can launch a “People’s War” in Taiwan and a bombing spree with “100,000 bombs targeted at Taiwan”.

- China’s military and arms production capability is underestimated by the West

- China’s weapons have been provided to Iran and Russia

- China is not just satisfied with replacing the US in the Middle East but wants to do that all over the world. Specifically in Latin America.

The danger that China poses to not just the Middle East but the entire world is significant.

We have seen how the Chinese have been targeting the various Western alliances and technology secrets.

Not just this. The Chinese have been building a fearsome genome database of different ethnicities. Next-generation bioweapons can target ethnicities based on genetics. Read this to fully understand the dangers from that.

With enough military heft at its disposal, China is now targeting US directly.

Panda goes for the Eagle

The direct targeting of the United States by China has been known for some time in terms of espionage. Even the belligerence at the seas and air have been recently seen. Aggression is rising.

A combination of Sentinel and Landsat satellite images reveals that a Chinese warship seemingly shadowed the Ronald Reagan CSG on Oct 20, while it was operating near Scarborough Shoal in the South China Sea. pic.twitter.com/KMbp4y6uZz

— Duan Dang (@duandang) October 21, 2023

But it is the direct infiltration and preparation for attacks that is not known much about.

Recent reports say that Chinese nationals have been infiltrating the US borders via Mexican cartels. With that, substantial amounts have been paid to them. By one estimate, just in 2023, that amount could have been close to $880 million!

Jennifer Zeng has been sharing some incredible insights on X regarding China for the past few years.

Here is her latest post.

This is significant!

What Rep. Dale Strong says about the infiltration of US borders by Chinese nationals is not about the border at all.

It is about the next US Presidential election.

And, for this, it is working closely with the Mexican cartels. China has been forging ties with these cartels via fentanyl drug operations.

China is the predominant source of precursor chemicals for Mexican criminal groups – principally the Sinaloa Cartel and Cartel Jalisco Nueva Generación (CNJG) – which then cook fentanyl and methamphetamine from them and smuggle them to the United States and elsewhere. Even though China placed the entire class of fentanyl-type drugs under a controlled regulatory regime in May 2019 and two key fentanyl precursors — NPP and 4ANPP — in 2018, the trade into Mexico remains. As the deputy chief of foreign operations of the U.S. Drug Enforcement Administration (DEA), Matthew Donahue, noted in March 2021, Chinese traffickers have virtually ceased to produce fentanyl analogues and focus solely on precursors, “with an unlimited and endless supply of precursor chemicals . . . coming from China to Mexico.” To a much lesser extent, Mexican criminal groups also source such precursors in India. (Source: The China connection in Mexico’s illegal economies / Brookings)

Please read our detailed discussion on the Myanmar Triads and its relations to the Chinese connections with the Mexican drug cartels.

In 2017, during the investigations, the DEA came across a new name. Chinese-American gangster named Xizhi Li. He was not just another guy, but a pioneer. He combined the hawala mechanisms (with the Chinese variant, of course) with the drug business to create a money laundering business that helped the Mexican cartels.

He helped these cartels to convert the small currencies of the twenties and hundreds they got from the U.S. streets that students and individuals gave them into legitimate riches. Riches that they could use to buy goodies like yachts, mansions, weapons, and technology, and even bribe the police and politicians. (Source: How a Chinese American Gangster Transformed Money Laundering for Drug Cartels /ProPublica )

One thing that came out clearly in the interviews with the intelligence operatives was that the main motivation for the drug trade in the US was "To fan the flames of hate and division." Their main aim was to hurt the United States.

“We suspected a Chinese ideological and strategic motivation behind the drug and money activity,” said former senior FBI official Frank Montoya Jr., who served as a top counterintelligence official at the Office of the Director of National Intelligence. “To fan the flames of hate and division. The Chinese have seen the advantages of the drug trade. If fentanyl helps them and hurts this country, why not?” More than half a dozen national security veterans interviewed by ProPublica expressed similar views, most of them speaking on the condition of anonymity because of the sensitive subject. But they acknowledged that the alleged state complicity is difficult to prove.(Source: How a Chinese American Gangster Transformed Money Laundering for Drug Cartels /ProPublica )

Now, think about it for a moment. The Chinese strategy is to bleed the US from within when "the time is right".

It is the sine qua non of the "People's War".

Something that the Chinese journalist has warned of in the clip from Lei's Real Talk.

The Chinese mouthpieces of the CCP have been warning of the battle with the US being a "real people's war".

Even the United States Marine Corps University has discussed this as well.

And in all of this, China may not just be looking at its own "army of illegal PLA Chinese nationals" but also the Islamist terror gangs belonging to ISIS.

After the initial anger against the Chinese, there has been a strange relationship underway between the Chinese and the Islamic State.

That should be seen as evidence of deeper trouble. Specifically when their silent recruits may be walking in plain sight!

Here is a video that one saw on social media. A person with knuckle dusters, illegal in the UK, working with a non-smartphone (nontrackable) in London Metro. Apparently, this is being seen more frequently these days.

Internal insurgency warriors of sleeper ISIS cells?

Where are we headed?

We had already discussed the situation of the Hamas attack being the start of World War 3.

We maintain that.

That was just the beginning.

The economics, supply chains, and potential actions by China suggest that just as the Mumbai attacks of 26/11 may have been lessons for the Hamas attacks, the lessons from that audacious attack may have provided a lot of lessons for China, Iran, and many Islamic terror organizations to launch much deadlier and decisive attacks in Europe and the US.

Of course, the target countries may not just be them. Taiwan and India can also be prime targets.

With these attacks, a global supply chain and trade crisis can be unleashed along with a battle that has the underpinnings of a "People's War".

The targeted nations, as is the case with Israel, will not have a lot of leeway to bomb the adversary. An adversary who would have covered his tracks well.

A combination of economic and geopolitical upheaval will play over each other.

Video Corner: Semiconductor Supremacy

We have discussed about the semiconductor race and the ongoing battle between the US and China. It is a significant topic that we should know more about. That is why I wanted to share a more in-depth video for your viewing.

Comments ()