How Tariffs, AI, and Robots Will Reshape Industry and Humanity

Tariffs are breaking old trade ties. AI and robots are rewriting the rules. The U.S.–China split is just the beginning of a new world map drawn in algorithms, not alliances.

Hindenburg Report on Adani Group has created a splash and stocks have lost value. Is it credible? What can one make out of it? A detailed look!

When the basis of the attack on someone is rather irrelevant or not meaningful, but the impact is significant, then one needs to pause.

For, it is not the main piece that is the critical weapon in the battle facing him, but the ecosystem and cacophony of the other players that are the real artillery.

The main piece is just a placeholder. The orchestra that is accompanying it is using it as the rallying point. Useful but not significant going forward.

So, the smart ones will focus on what is to come based on the initial small piece. What it can contribute to?

That is where the real rub is!

We are no investment experts, but we want to review the Hindenburg report and see how much of it makes sense and how much of its "research" really stands scrutiny.

So let us get started.

First off, when anyone who is doing serious research-based work starts using superlatives or 'drama creating" words, it should be the first immediate warning of the shaky ground on which that work is standing. If the work is really serious and has the backing of facts and research, it does not use words meant to create drama.

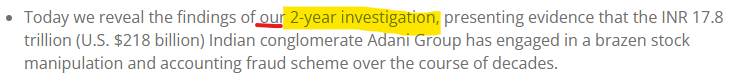

The very first claim of Hindenburg puts you off:

engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades

They start off with their allegation without having proved anything. And that they do with the word "brazen". Brazen translates into "bold and without shame".

Hmm. That is quite interesting.

Either it is stock manipulation or it is not. One does not give a rat's arse about the subjective manner in which you think someone did it. He did it or he didn't.

Hindenburg report then states their modus operandi.

Our research involved speaking with dozens of individuals, including former senior executives of the Adani Group, reviewing thousands of documents, and conducting diligence site visits in almost half a dozen countries.

The first part - "speaking with former senior executives and dozens of individuals" is another put-off. It's hearsay at best and prone to prejudice at its worse. What if the "senior executive" you talked to was disgruntled because she or he was fired? Of what material use is listening to such a person? And, does it help the analysis in terms of actual facts of the financial situation of Adani Group?

The second part - reviewing thousands of documents is expected. Duh! Again, the quantity is irrelevant. That someone wants to throw the largeness of the number suggests another "drama moment".

But what one really finds intriguing is "conducting diligence site visits". Were they officially arranged? Espionage? Or just cursory visits without deliberate and serious discussions?

If it wasn't the last one, then they are of very little value in actual terms.

But what is instructive is that the report shares an intriguing source for its allegations.

Mahua Moitra?!

Really?!

She is, to borrow the Hindenburg style of writing, the "Queen of over-the-top polemical rants" even in the Indian Parliament.

If someone's research is based on the ideas shared by such a politician who is hopelessly antagonistically predisposed to Modi and his imagined "cronies" then it is not really worth taking seriously. (For, Adani has been probed and even fined by the Modi administration in recent years).

And this becomes even more interesting when you see that this extreme anti-Modi politician has been running a kind of crusade against Adani for quite some time.

Actually for around 2 years now.

Which is curious.

Because Hindenburg's "research" also started around the same time!

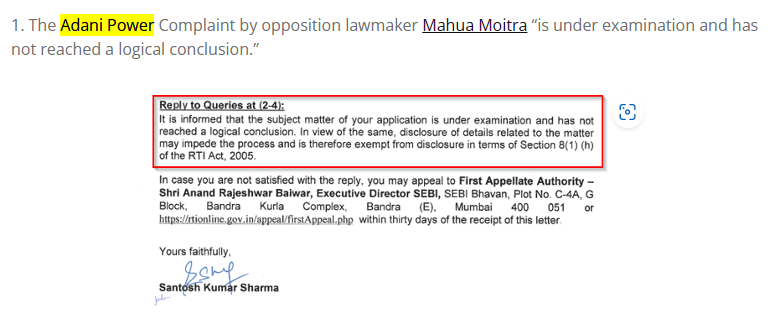

Mahua Moitra comes up again with respect to Adani Power.

So the question is were they (Hindenburg and Mahua Moitra) working in parallel and in consonance, if not together?

For whatever it is worth, let us get back to the report.

After the claim of having "talked to many people" comes the bomb.

Their verdict.

7 key listed companies have 85% downside purely on a fundamental basis owing to sky-high valuations

Sky-high? Well, they can be what they are. Do you think they are very high? Then state that. Another "drama moment" to underline their contention that there is an 85% downside.

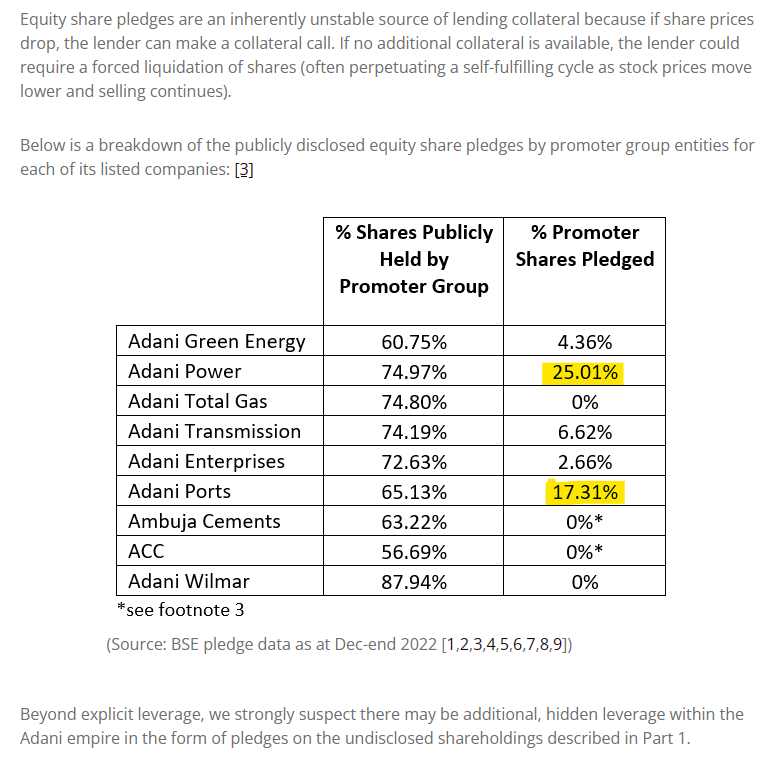

The first reason is that the Adani group has taken a substantial debt by pledging its shares (oh they are inflated shares, we are told) for loans. Because of that, the entire group is on precarious financial footing.

This practice of using your own stock as collateral for loans is pretty common and called "Loan Stock". There is nothing new in that.

The downside here, if it goes bad, is that the lender (bank) will own the shares (collateral) if the company cannot repay the loans.

That is a downside for Adanis and not the company. But when you look at the detail Hindenburg provides, one is left perplexed.

Ok, so the only two companies that may be at risk of substantial equity going in the hands of the lending entities are Adani Power ad Adani Ports. If these companies together could not pay their loans fully then the shares with Adanis will drop to 49.96% in Adani Power and 47.82% in Adani Ports.

That won't make the lenders majority shareholders. So what is the whole hullabaloo about?

This is followed by another rant.

Ok? So what? Most Indian businesses are that. Even for the most part, the Tata group has been like that. If the control of the whole group is in the hands of a few individuals, that is none of anyone's concern. Whatever works for one particular culture is the right thing for it. Laxmi Mittal's acquisitions have seen its own chosen executives go into, say Arcelor, and take over the control and turn things around.

One doesn't know whether it is a serious statement or a value judgment or simply an envious rant.

Now another allegation.

So, allegations were made against Adani Group. What was the final result of those investigations? If they are ongoing, then let them complete. If you have additional inputs, share them in a court of law. Otherwise, what is the value of this statement really?

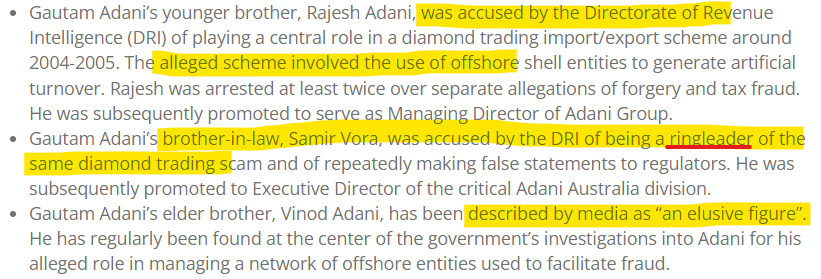

This is followed by a series of allegations regarding people within the group.

This further discredits Hindenburg. All accusations collated together while using words like "ringleader" (as if it's a mafia group doing some smuggling). And, not sure - since when did being an "elusive figure" become such a dangerous thing? Some people like their privacy. If you have specific points about someone's performance - then make them. Otherwise, no one is obligated to share their life with you!

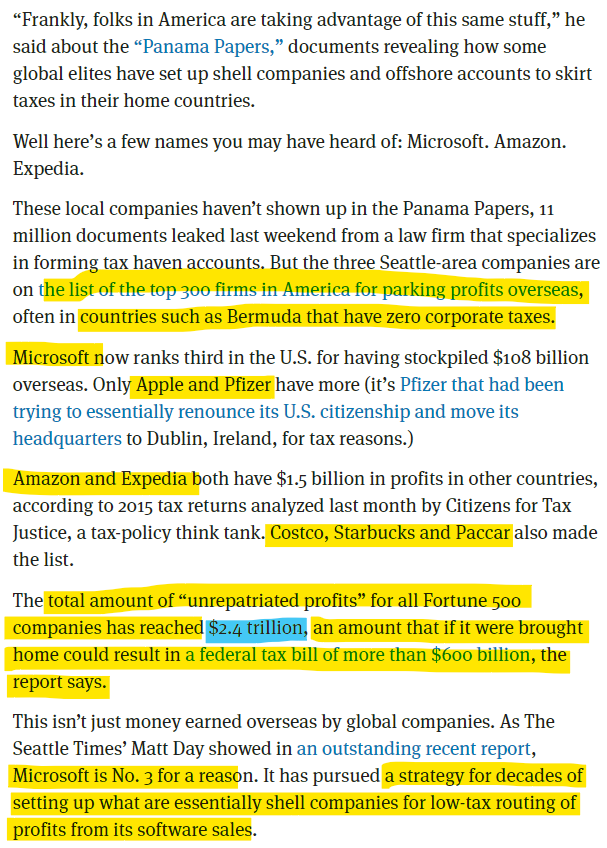

Is evading taxes a good thing? Is it legal? The answers to these lie between the grey and no area.

Why does one say that?

Because large businesses the world over do these things on regular bases.

So much for the shock value that Hindenburg wants to create by saying the Adani group also uses the same tactics as most of the Fortune 500 do anyway!

But first some bragging is in order by Hindenburg for the "thoroughness" of its research.

Now that is quite impressive. Downloaded and even cataloged the entire Mauritius corporate registry! OMG! Why they miss the count of all-nighters they pulled off in this exercise is beyond one.

You do what you do for your analysis. Why would you make it part of your main summary points?

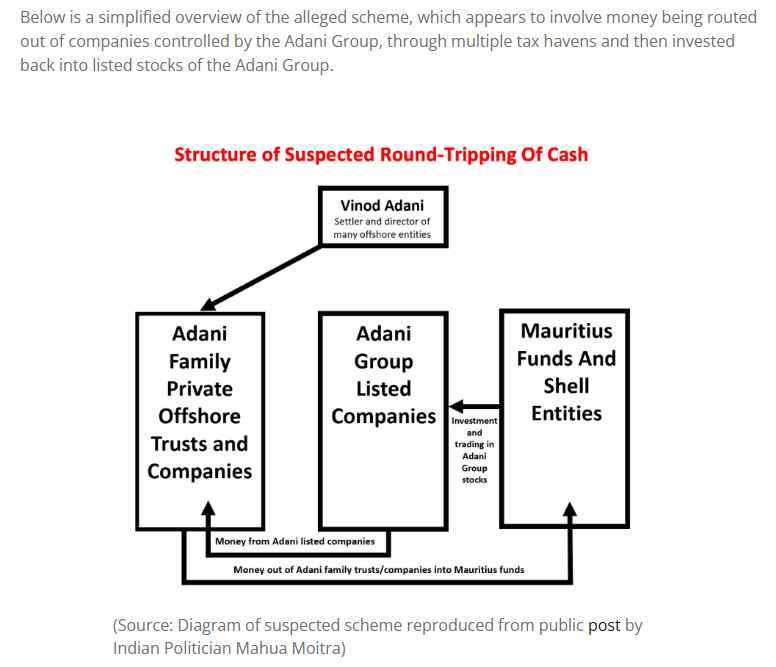

In any case, Hindenburg's "research" then discusses about the shell companies in Mauritius and the funds that invest in Adani group taking substantial shares.

The report discusses 5 funds:

These five funds, the reports alleges, are controlled by Monterosa Investment Holdings (“Monterosa”)

The information about these Mauritius-based funds owning shares in Adani Group companies is not exactly news. A June 2021 Moneycontrol had discussed the same connections.

Albula Investment Fund, Cresta Fund and APMS Investment Fund together own shares worth more than Rs 43,500 crore in Adani Enterprises, Adani Green Energy, Adani Transmission, and Adani Total Gas.

In fact, when National Securities Depository Ltd (NSDL) froze the accounts of three Foreign Portfolio Investors (FPIs) - i.e., Albula Investment Fund, Cresta Fund, and APMS Investment Fund in June 2021 - Adani shares plunged.

These three FPIs along with Elara India Opportunities Fund, have been investing in companies that ultimately went bankrupt or had shady histories. They do have a substantial investment in the Adani Group companies.

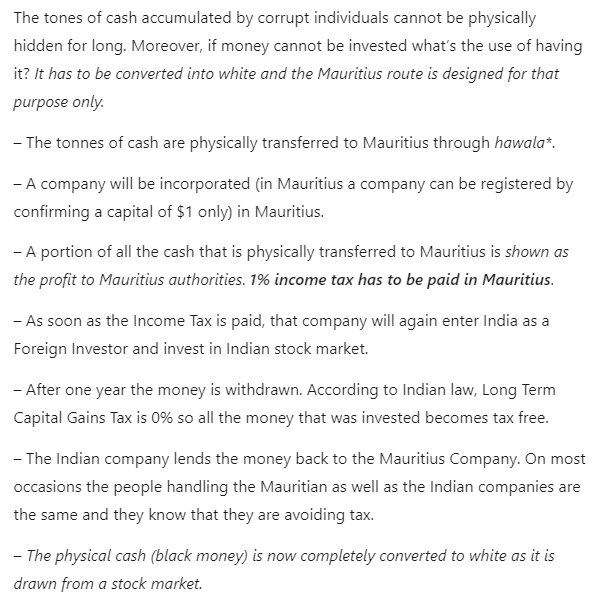

That Mauritius Route, which was brought in by P. Chidambaram, was used as a tax-evading mechanism because of which Mauritius became the largest FDI source country, is not a new revelation.

Most Indian countries have used the proverbial "Mauritius Route".

The modus operandi followed to save the capital gains was very similar.

FIIs operating in India are required to pay taxes on short-term capital gains (at a rate varying between 20 per cent and 30 per cent in recent years) if these entities repatriate their earnings in less than a year. The tax rate is lower at 10 per cent if the earnings remain within the country for more than a year. However, the best way out for FIIs is not to pay any tax at all irrespective of the time taken to repatriate capital gains. This is done by registering a sub-account in Mauritius which country does not levy any capital gains tax. Voila! (Source: Why Mauritius Has Everything To Do With The Stockmarket Scandal / Outlook India)

A simpler explanation of the whole process is below.

So Mauritian-based companies, under the Double Taxation Avoidance Agreement could sell shares of the Indian companies and be exempt from Capital Gains. The tax-avoiding entities would route their investments into India via Mauritius-based shell companies. This way they would avoid paying taxes. Between 2000-2015, 34% of Foreign Direct Investment into India came from Mauritius.

In 2016, India renegotiated the treaty (Source: Economic Times) and it gave India the right to tax capital gains made by investors on shares in Indian companies. The new provisions also covered shell companies.

From 2017, Mauritian investors will be taxed on capital gains at half the Indian rate (meaning 7.5%) till 2019, after which the full rate will apply. This basically removes the incentive for tax avoiders to route funds through Mauritius as they will be taxed anyway. In that sense it plugs a major loophole. It is also one of the remedies sought in my essay and it is a stroke of good fortune that action on the issue has been taken so quickly. Shell companies are exempt from the half rate during the two year transition period. If a Mauritian resident company has spent less than 1.5 million Mauritian Rupees on operations in the preceding year, it will be deemed a shell company. This is a rigorous definition and will include almost all shell companies. (Source: TaxJustice.net)

The Mauritius Route was used extensively by the Indian corporate world. There is no new revelation here.

Then there is a section on Mundhra Port.

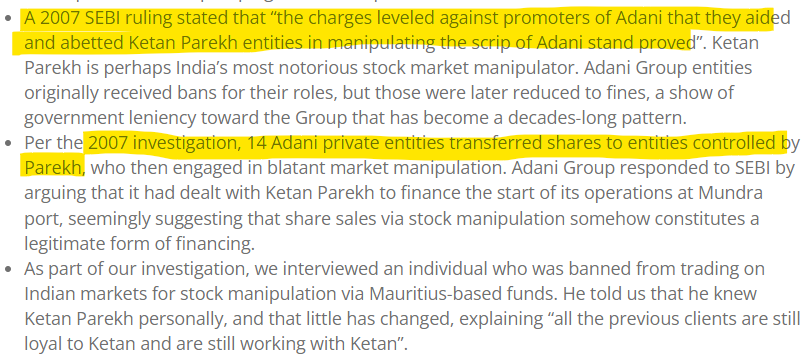

And the whole issue with Ketan Parekh.

Bringing up the Mundhra Port IPO now in the tone Hindenburg does is nothing short of comedy. Why?

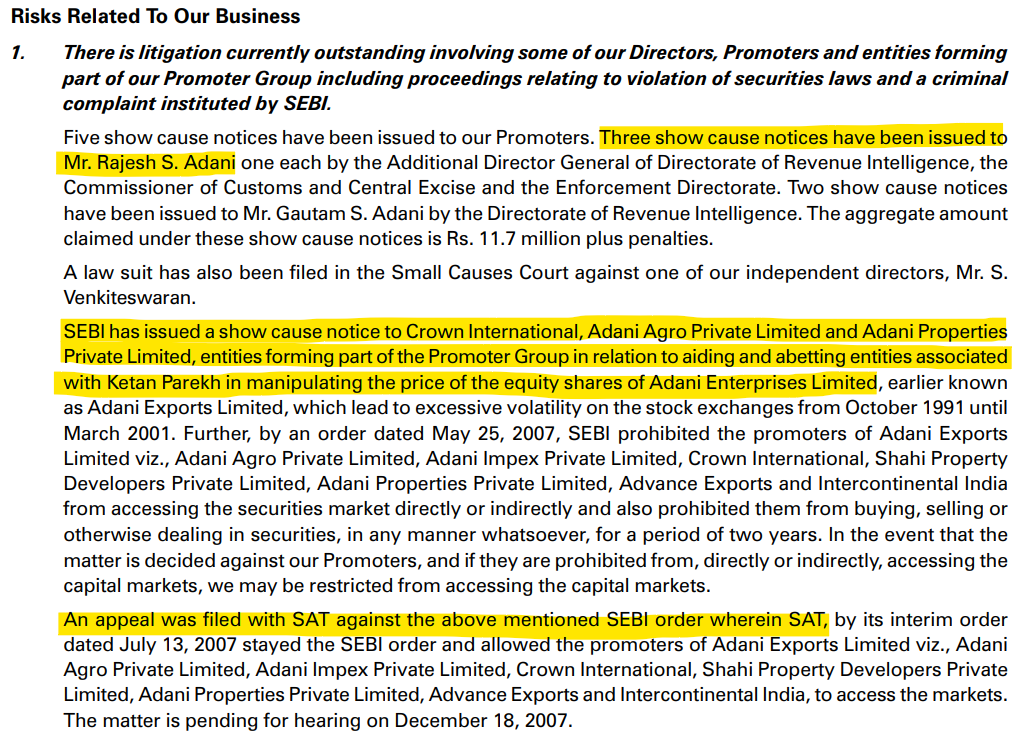

Because one look at the Mundhra Port IPO prospectus shows that the #1 Risk stated there discusses it in detail.

The Securities Appellate Tribunal gave its decision on April 24th, 2008. You can read it here.

When you start quoting from the IPO's prospectus itself in a way that it is a conspiracy, then it says more about your research than it says about the target of your research.

The IPO was a success and the stocks doubled after the launch.

Shares of Mundra Port and Special Economic one more than doubled, raising about US$4.4 billion on the company's trading debut on the Bombay Stock Exchange (BSE), reports Bloomberg. (Source: PortNews)

In short, the stock market had already factored in the SEBI investigation that Hindenburg thinks is relevant now!

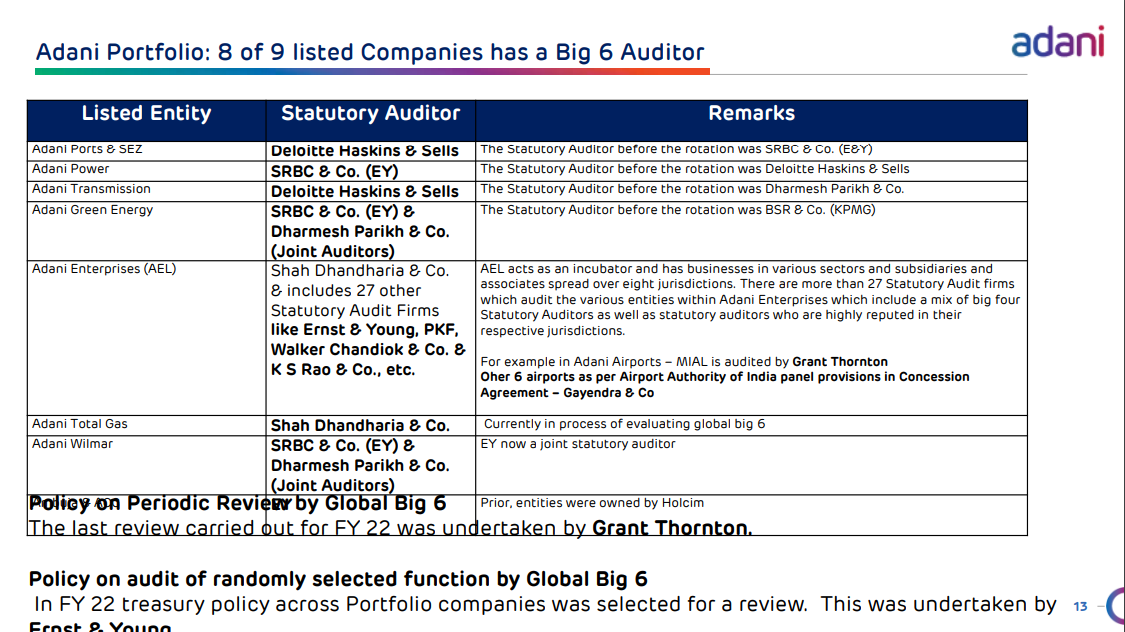

The auditors of Adani Total Gas SHah Dhandharia also come in for criticism.

That is a risk and a red flag yes. But not a crime. As Adani's response states, 8 out of the 9 Adani Group companies have a Big 6 Auditor.

So, if the auditing of the companies was only in the hands of 20-somethings then one could say that something is totally off. But that isn't so really.

At the end of the summary, Hindenburg laments that Gautam Adani, despite saying he likes criticism has litigated against those who wrote against him or his companies and those journalists got jailed.

And?

Using existing laws and courts to block what someone considers defamation and proving it in court is somehow bad?

Isn't this tactic used by almost every US company as well?

Yes, it sucks and is not great for the public good, but is it a crime to use the existing laws?

Now back to the whole risk factor and the downside.

As we have seen, none of the assertions or allegations by Hindenburg, their "drama moments" notwithstanding, are really new revelations. These have been a matter of public record. Even part of the Adani Company's IPO prospectus.

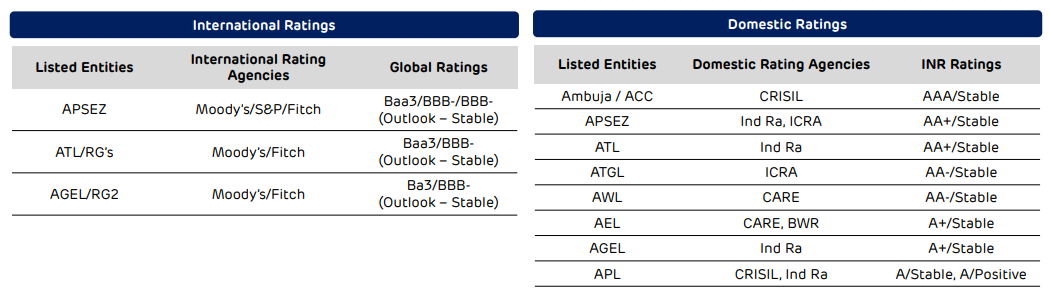

So, it would stand to reason that the credit rating agencies would have factored them in. How do they still see the Adani companies?

Well, last year, Moody's Global ESGRating put Adani Ports & Special Economic Zone 1st among the Indian companies and 9th out of 844 companies in Emerging Markets globally!

APSEZ has been ranked 1st among 59 Indian companies and 9th among 844 companies in the Emerging Markets globally across all sectors which reflects its standing among all the other global ESG leaders (Source: ABP)

And, as per the various rating agencies, the score seems to be fairly stable for the Adani companies.

The only way Hindenburg's so-called research could have been worth the paper it wasted if it had revealed information that has not been known in public space and is completely new. But as we saw, there was nothing new.

A detailed analysis that could have shown why the Adani Group is about to fall apart would have been meaningful. Irrefutable in its math and modeling so there is no discussion.

The real thing is to look at something else.

This Hindenburg report has been tom-tommed in every major global publication. But the fact is that Adani Group companies are listed on the Indian stock exchanges. So who is benefitting?

Because it is tough to believe that regurgitating of old information could result in losses in shares on Indian exchanges so dramatically.

What needs to be done is - to look at who took short positions prior to the Hindenburg Report and look into their link to the group. Also, see the role played by the media to make this obviously trashy amateur report bigger than it really is.

This may have been used by some Indian partisan groups to make money. One would be curious about Mahua Moitra and those close to her. How they handled the whole scenario.

We had written this piece in March 2021 - where we discussed the extreme vulnerability of the Indian corporates and how they are really sitting ducks.

The fact is that other billionaires, far down in the "Rich people's" totem pole have been able to target and rattle the Indian billionaires like Adani and Ambanis. And the Indian rich men and women can only defend themselves. As opposed to taking the fight to their adversary's home turf.

The right move for Adani would have been to have a strong financial firm share a more detailed, credible, and factual report. That would go a much longer way to discredit Hindenburg for this trash.

Meanwhile, the focus should be on who made money on the Indian exchanges by shorting Adani shares.

Ayn Rand was a rage with everyone I knew during my school years. The extremely ill-read person that I am, I have not read her books. But I chanced upon her extremely insightful interview on Youtube.

Now Christian morality derives from the Church framework where Jesus was used as a mascot to create loyalty as a virtue while making the Church the owner of that mascot such that the Church had unbridled power. Ayn Rand was revolting against that power framework.

The Indian way was very different. Although the short-sighted and spiritually illiterate commentators have equated the Dharmic way with the Abrahamic moral framework. The Dharmic way was based on the understanding of Karma, where the emphasis was on action and not on result. Doing what was needed in any situation with the aim to break free from the impact of any Karmic burden that one carried. There were ways laid down for those who were not on the spiritual path - to minimize their burden. Those on a spiritual path, were anyways on their way to dismantling it.

The dharmic way shunned morality completely as it was considered a pretense. The focus was on raising consciousness. For example, when Ratnakar the dacoit attacked the Sages in the forest, they did not teach him morality. They set him on a spiritual path and Valmiki took shape.

So, while I understand what Rand is saying, I consider this as another example of thesis and anti-thesis. Where the anti-thesis includes every component of the thesis in it. Anti-thesis, therefore, is not something radically different from the original thesis. It is within its boundaries. Just anti it.

If you like our content and value the work that we are doing, please do consider contributing to our expenses. CHOOSE THE USD EQUIVALENT AMOUNT you are comfortable with.

If you like this post - please share it with someone who will appreciate the information shared in this edition.

Today’s ONLINE PAPER: Check out today’s “The Drishtikone Daily” edition. - THE DRISHTIKONE DAILY