How America's Economic Warfare Has Brought the World to the Geopolitical and Financial Brink

Iraq wars, Afghan War, Middle Eastern Wars, and the one now in Ukraine were perpetuated on an unsuspecting world by profit-seeking elites. The impact on the US and the world economy and geopolitical structures is existential. World is teetering on the edge of a precipice!

Xerxes I, ruled the Persian Empire from 486 to 465 BC. The Persian Empire at the time was the largest and most powerful in the ancient world, stretching from modern-day Pakistan across the Middle East to the Danube River.

Xerxes' hubris was most evident during his invasion of Greece. Believing in the absolute superiority of his forces, Xerxes amassed a colossal army and fleet, estimated by modern sources to be between 100,000 and 200,000 men and a fleet of 1,200 ships. (Source: Xerxes I | Hubris / 15 minute podcast)

Wise counsel around him warned him against this.

The entire campaign can be divided into three major battles.

- Battle of Thermopylae: Although initially successful, the Persian forces faced stiff resistance from a small Greek force led by the Spartans.

- Naval Battle of Salamis: Xerxes' decision to engage the Greek navy in the narrow straits of Salamis proved disastrous. The Greek navy, under Themistocles, inflicted severe losses on the Persian fleet, which crippled their naval support and supply lines.

- Retreat and Aftermath: Following the defeat at Salamis, Xerxes was persuaded to retreat to Persia, leaving his general Mardonius to continue the campaign. However, the Persian forces were ultimately defeated at the Battle of Plataea, marking the end of the invasion and the beginning of the decline of the Persian Empire

Hubris, over-confidence, and arrogance of overwhelming power were his undoing.

This not just marked the decline of Xerxes' reign but also set the stage for the eventual fall of the Persian Empire to Alexander. (Source: Reflections on the Rise and Fall of Empires / BigThink)

Please Contribute to Drishtikone

What we do takes a lot of work. So, if you like our content and value the work that we are doing, please do consider contributing to our expenses. Choose the USD equivalent amount in your own currency you are comfortable with.

Standing up a Sanction-resistant Bloc

On February 26, 2022, a coalition of Western countries including the EU, US, Canada, and UK agreed to ban select Russian banks from the SWIFT international payment messaging system.

On March 2, 2022, the EU formally implemented sanctions prohibiting seven Russian banks from using SWIFT services, effective March 12, 2022. (Source: Russian banks banned from SWIFT / UK P&I Club) The banned banks were:

- VTB Bank

- Bank Otkritie

- Novikombank

- Promsvyazbank

- Rossiya Bank

- Sovcombank

- VEB

The removal from SWIFT, coupled with other sanctions, severely limited Russia's ability to conduct international transactions and access global financial markets. (Source: What Does Russia’s Removal From SWIFT Mean For the Future of Global Commerce? / Foreign Policy) This led to a significant devaluation of the ruble and economic instability.

That started a global realignment that took on a different shape altogether. That of de-dollarization.

As it turned out, the sanctions by US and the West did not create much of an impact on Russia.

After all, sanctions aren't being used anymore. They are being abused.

While the Western media was pumping its chest on how the Russian economy would collapse due to sanctions, Russia had its own plans.

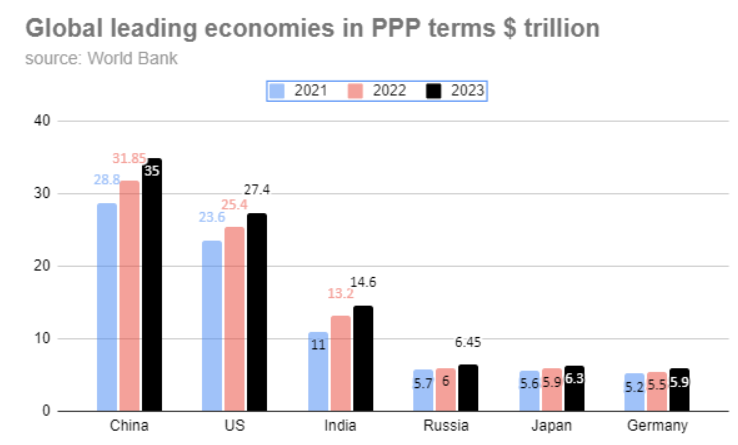

Not many noticed but Russia, despite being at war and having strong sanctions from the US and Europe against it, has overtaken Japan as the 4th largest economy in the world.

What does this show?

And, it is not just Russia that is on this de-dollarization and trade fragmentation bandwagon, it is almost everyone outside the US/NATO Bloc.

De-Dollarization: Immunity from Sanctions and BRICS

From Saudis to UAE to India to Africa to of course China - the move away from the US-led financial system or more colloquially now called de-dollarization started taking shape.

In less than two years, the countries outside the US bloc are now getting ready to become sanction-immune.

In all this, the BRICS organization has a big role to play.

What does BRICS offer and what is its relevance?

These observations by "Romegas" on Simon Mercieca's Free Press are very insightful.

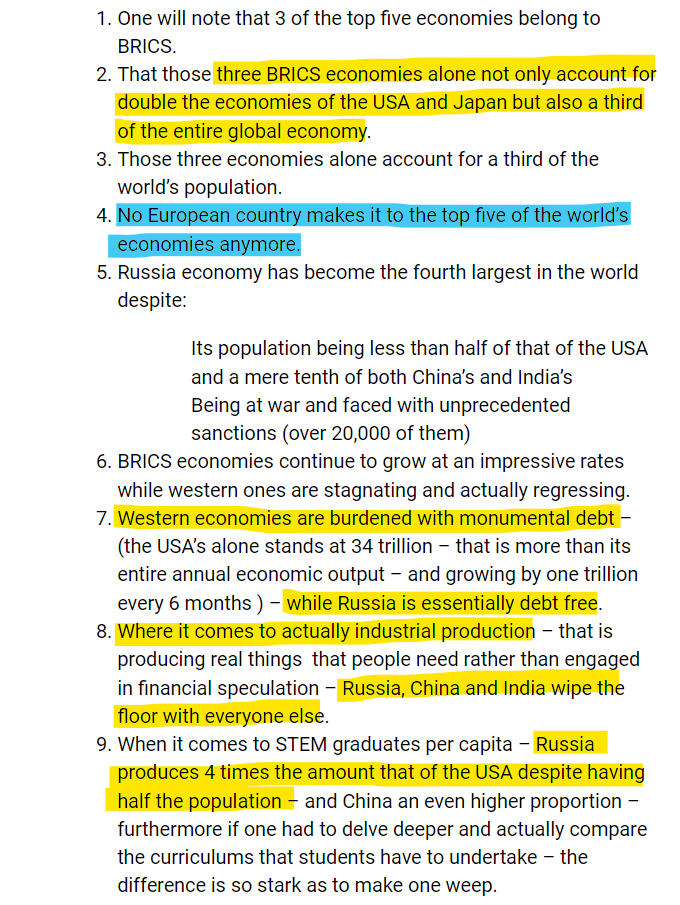

Now look at how the BRICS nations are changing their wealth holdings and you will see an interesting pattern.

Their focus is on Gold.

In 2023, the BRICS nations emerged as the largest buyers of gold, with China, Russia, and India leading the charge in stockpiling the precious metal worth billions of dollars. According to the latest data from the World Gold Council, China alone added 225 tonnes of gold to its reserves in 2023. This gold-buying spree is primarily driven by China, followed by Russia and India.

Breakdown of Gold Purchases by BRICS Nations

The main headline from BRICS is that these five nations - specifically China, Russia, and India are amassing gold reserves.

Let us evaluate the situation in each of these three countries with respect to the gold reserves.

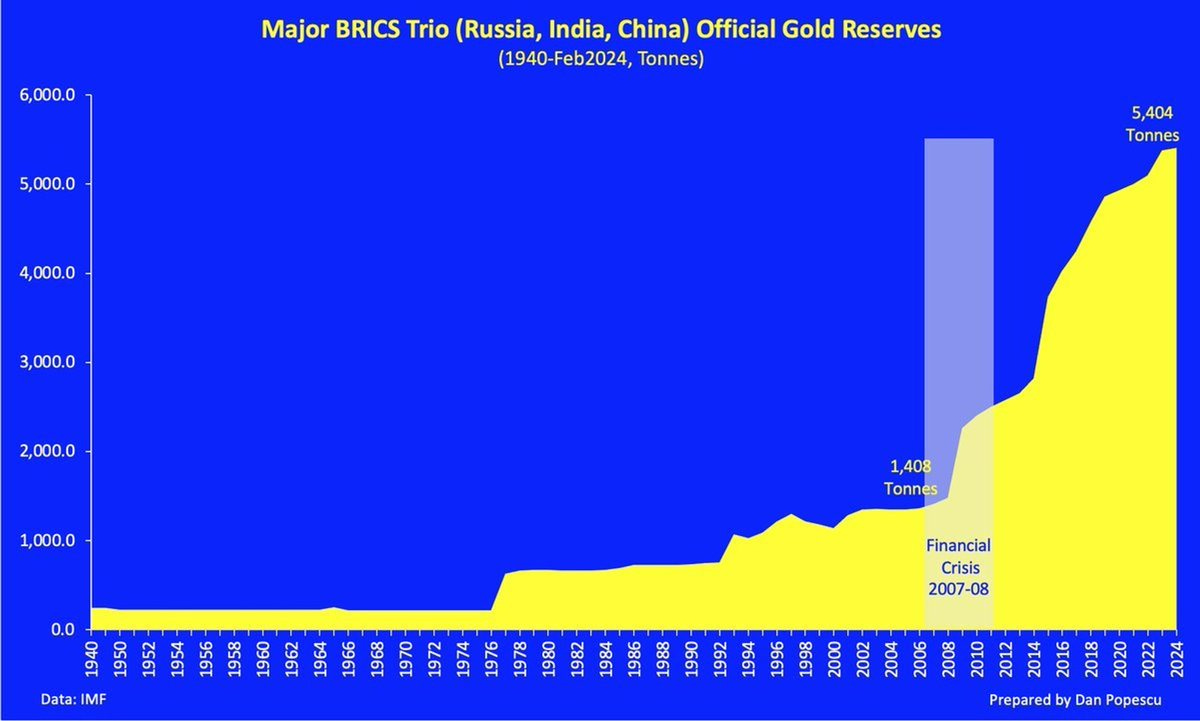

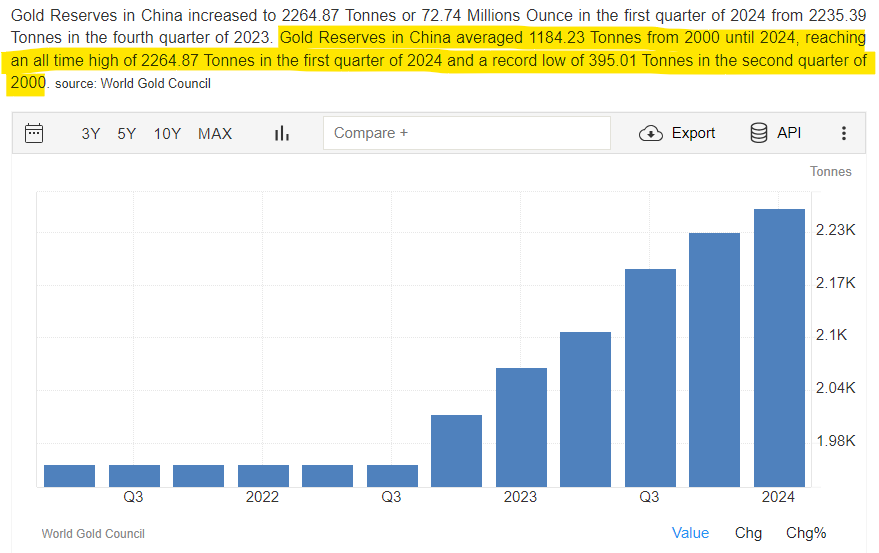

China:

China significantly increased its gold reserves, adding 225 tonnes in 2023. By the first quarter of 2024, China's gold reserves had grown to 2,264.87 tonnes, up from 2,235.39 tonnes in the fourth quarter of 2023. This accumulation is part of China's broader strategy to reduce reliance on the US dollar and strengthen its currency's global standing.

Russia:

Russia's gold reserves reached 2,332.76 tonnes as of January 1, 2024. Throughout 2023, the value of these reserves increased by 14.5%, rising from $136.077 billion in January 2023 to $155.858 billion by the start of 2024. Gold constituted 26% of Russia's international reserves, up from 23.4% at the beginning of the year. (Source: Russia's gold reserves amount to 2,332.76 tons at beginning of 2024 / Xinhua)

India:

India's gold reserves saw a substantial increase over the past five years, rising by 40% between March 2019 and March 2024. By the end of March 2024, the Reserve Bank of India held a total of 822 metric tonnes of gold, with 408 metric tonnes held domestically. The share of gold in India's total foreign exchange reserves increased from 7.37% in September 2023 to 8.15% by March 2024. (Source: Domestically held gold reserve rise by 40% in 5 years, shows RBI data / Business Standard)

To get a better picture of the gold reserves in India, please read the detailed take in this newsletter -

The go-to holder of sovereign wealth for the BRICS nations is gold.

Dumping US Treasuries for Gold

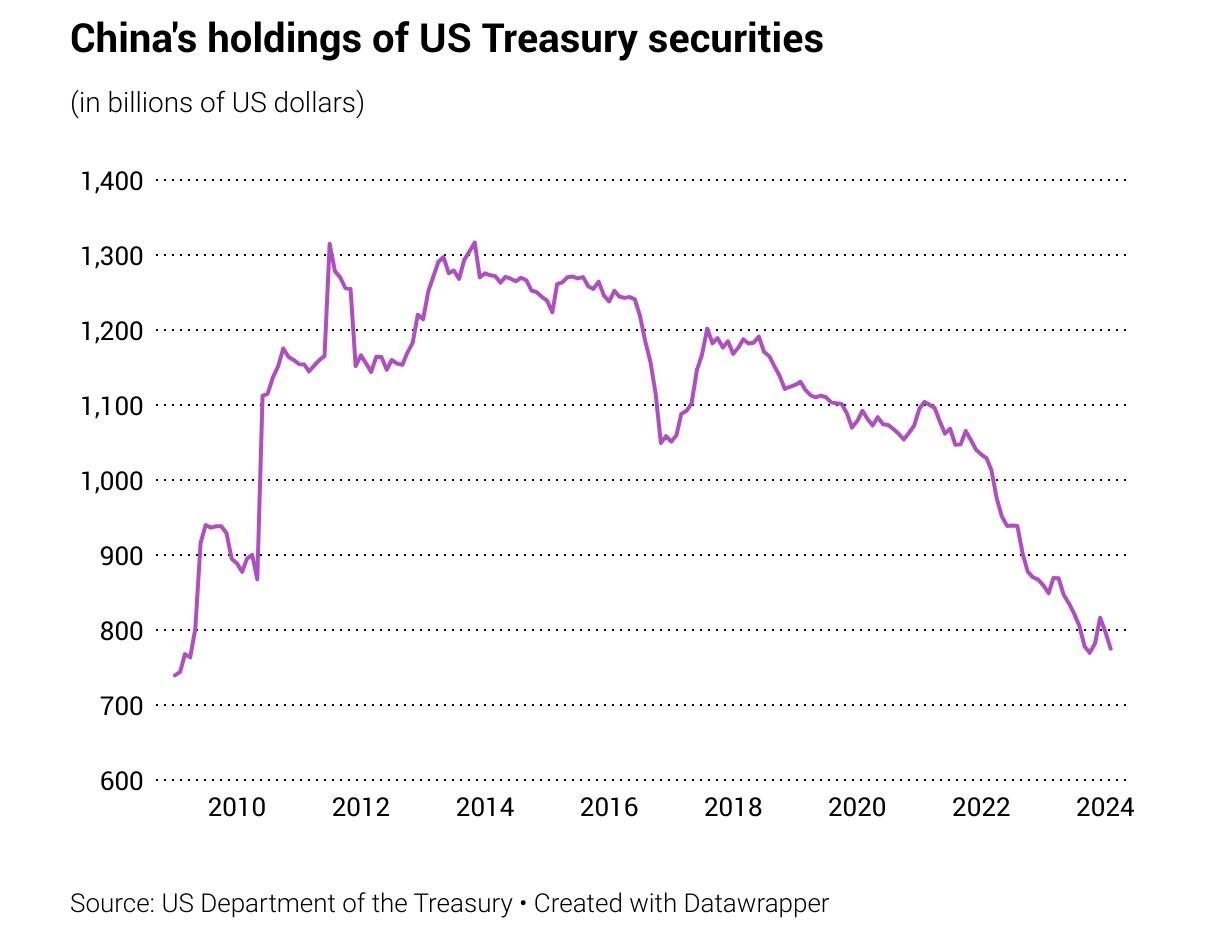

It is interesting that while China is increasing its gold reserves, it is dumping its holdings of US Treasuries.

China offloaded another $22.7 billion in U.S. Treasuries in February, according to the latest data from the Federal Reserve. That dropped its total holdings to $775 billion. China still ranks as the second-largest foreign holder of U.S. debt, but the U.K. could soon overtake China and slide into the second position if the current trend continues. Japan ranks as the biggest foreign U.S. creditor with $1.17 trillion in Treasuries. The U.K. comes in third with $700.8 billion in U.S. Treasuries. China has been divesting itself of U.S. debt for several years. The country’s Treasury holdings have fallen to their current level from around $1.1 trillion in 2021. Chinese investment in U.S. debt hit a 14-year low in October. (Source: "China is dumping US treasuries and buying Gold" / FXStreet)

This is how the chart looks for the US treasury bonds.

IMF's Deputy Managing Director, Gita Gopinath, shares her analysis.

Looking at global FX reserves, the most notable development during 2022-23 has been an increase of gold purchases by central banks. Gold is generally viewed as politically neutral safe asset, which can be stored at home and be insulated from sanctions or seizure. It can also be an inflation hedge but cannot be easily used in transactions. The share of gold in the FX reserves of the China bloc has been rising since 2015—a trend not exclusively driven by China and Russia. Importantly, during the same period, the share of gold in FX reserves of countries in the U.S. bloc has been broadly stable. This suggests that gold purchases by some central banks may have been driven by concerns about sanctions risk. This is consistent with a recent IMF study[3] confirming that FX reserve managers tend to increase gold holdings to hedge against economic uncertainty and geopolitical including sanctions risk. Looking at China, the share of gold in total FX reserves has increased from less than 2 percent in 2015 to 4.3 percent in 2023. During the same period, the value of China’s holdings of U.S. Treasury and Agency bonds relative to FX reserves has declined from 44 percent to about 30 percent. This reflects both net purchases and valuation effects. The downward trend holds even if we account for the fact that some of China’s holdings of U.S. bonds may be held in Belgium (Euroclear), as some analysts suggest.[4] (Source: Geopolitics and its Impact on Global Trade and the Dollar / IMF)

What is astonishing is how the different economies and geopolitical blocs are behaving with respect to US Treasuries vs Gold reserves.

Same world, different strategies?

Keep looking at these charts - they tell the story of the world that is rather intriguing!

So China and more generally BRICS nations are going for the Gold and Western countries are reducing their reserves.

American Wars and Debt - The Greatest Wealth Transfer in Human History

It is quite obvious that the American taxpayers' money has been used to profit the elite in the Military Industrial Complex and politics.

But let us look a little closely into one of the most evil games that has happened in the last - at least - 24 odd years.

The Narcotics trade game.

The "War on Terror" after 9-11 attacks was ostensibly to take out Taliban and Al-Qaeda from Afghanistan.

Let us dive a little deeper into one inflection point that rendered the entire War on Terror a complete farce.

Yet no one discussed it with the seriousness it deserved!

The Kunduz Airlift - Why "War on Terror" was a Farce from Get-Go

Just 5 weeks into the attack on Afghanistan, the Americans and their allies - the Northern Alliance - were on the brink of victory.

Complete and unequivocal victory against the Taliban and Al Qaeda.

Then United States partnered with Pakistan to stop itself from getting to the finish line, while betraying the Northern Alliance!

It was the Kunduz Airlift.

The Kunduz airlift, also known as the "Airlift of Evil," refers to the evacuation of thousands of Taliban and al-Qaeda members, as well as Pakistani military advisors and intelligence agents, from the city of Kunduz, Afghanistan, in November 2001. This event occurred just before the fall of Kunduz to the Northern Alliance and United States forces during the early stages of the War in Afghanistan.

After the assassination of Ahmed Shah Massoud, the leader of Northern Alliance, his fighters marched against the Taliban and Al Qaeda and had them cornered in Kunduz.

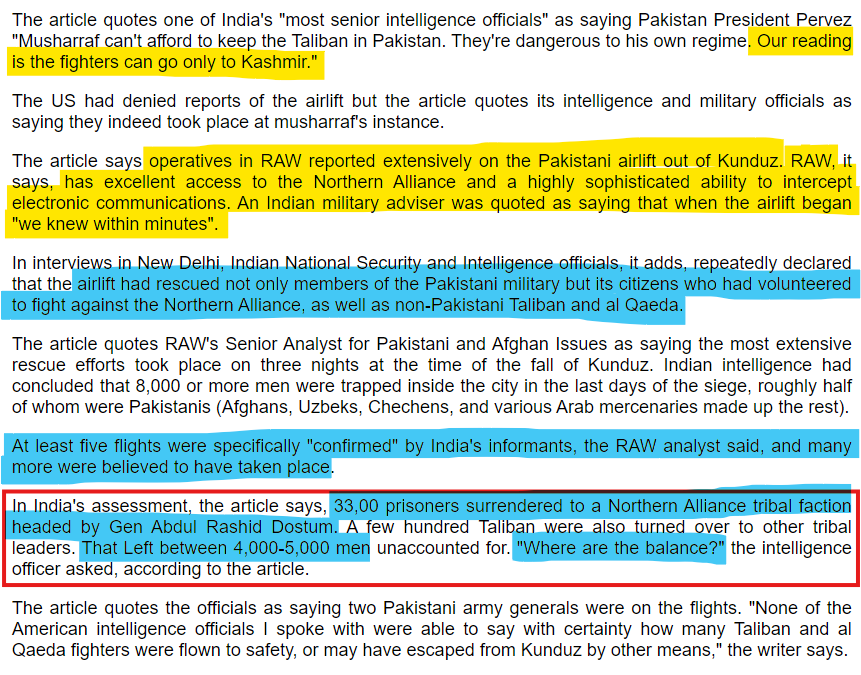

Another report, this in the Times of London, quotes an alliance soldier angrily denouncing the flights, which he reasonably assumed were conducted with America’s blessing. “We had decided to kill all of them, and we are not happy with America for letting the planes come,” said the soldier, Mahmud Shah. (Source: 'The ‘airlift of evil’ / NBC)

The anger and determination within the Northern Alliance were clear - the Taliban (and their allies Al Qaeda) were about to be smoked out.

Surrender negotiations began immediately, but the Bush Administration heatedly—and successfully—opposed them. On November 25th, the Northern Alliance took Kunduz, capturing some four thousand of the Taliban and Al Qaeda fighters. The next day, President Bush said, “We’re smoking them out. They’re running, and now we’re going to bring them to justice.” (Source: The Getaway" by Seymour Hersh / The New Yorker)

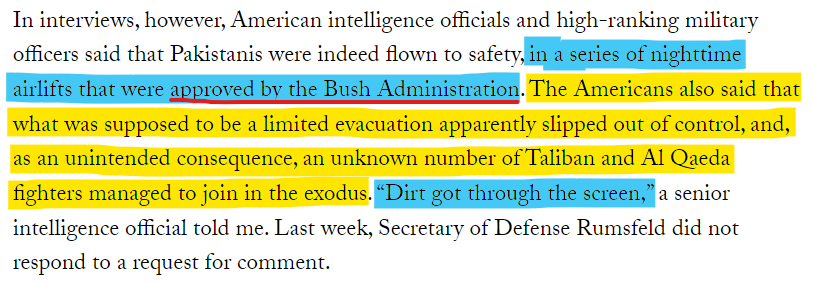

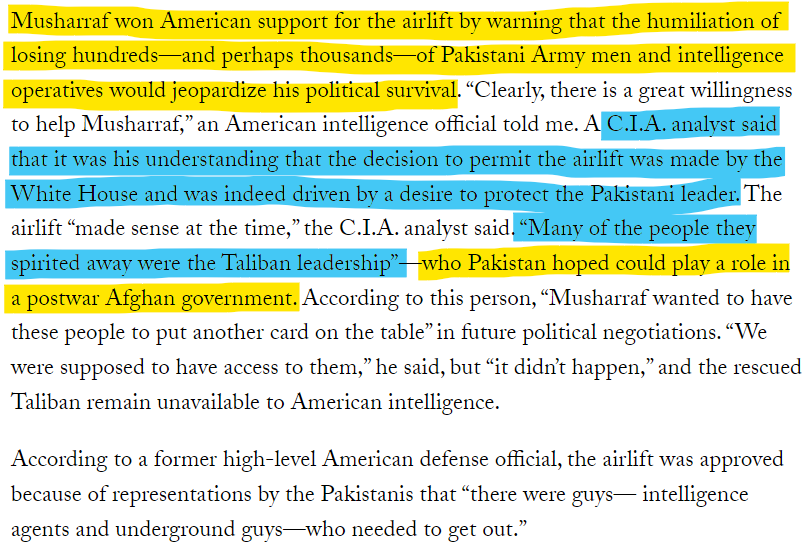

Great talk, right?! But the Bush administration was playing a double game. On the other side, they were working with the Pakistanis to allow the Pakistani Air Force to, apparently, evacuate their fighters fighting alongside Al-Qaeda and the Taliban in Afghanistan. Instead, thousands of Al Qaeda and Taliban terrorists made their way to Pakistan.

Whether these terrorists were pushed to Kashmir or sent back to Afghanistan to kill the American military personnel is something that would have been known to the ISI and the CIA.

But as American Intelligence operatives put it - Dirt got through the screen. Dirt indeed!

According to reports, Pakistani President Pervez Musharraf contacted U.S. President George W. Bush around November 18, 2001, to request permission for the airlift. Bush and Vice President Dick Cheney reportedly approved the operation, though most cabinet members were not informed.

The evacuees were reportedly taken from Kunduz to Chitral in Khyber Pakhtunkhwa and Gilgit in the Northern Areas of Pakistan.

With this, we have established that America's War on Terror after that was basically a farce.

The game should have been over at that time. Yet, at least 5000 of these were allowed a safe passage to Pakistan. The same guys who came to kill the Americans, Afghans and others in Afghanistan.

All to keep a war on that should have been over on November 25th! And it dragged on for 20 years becoming America's longest war. For what?

So much suffering happened. An entire country was destroyed. So many families in the US lost their dear ones.

The human cost?

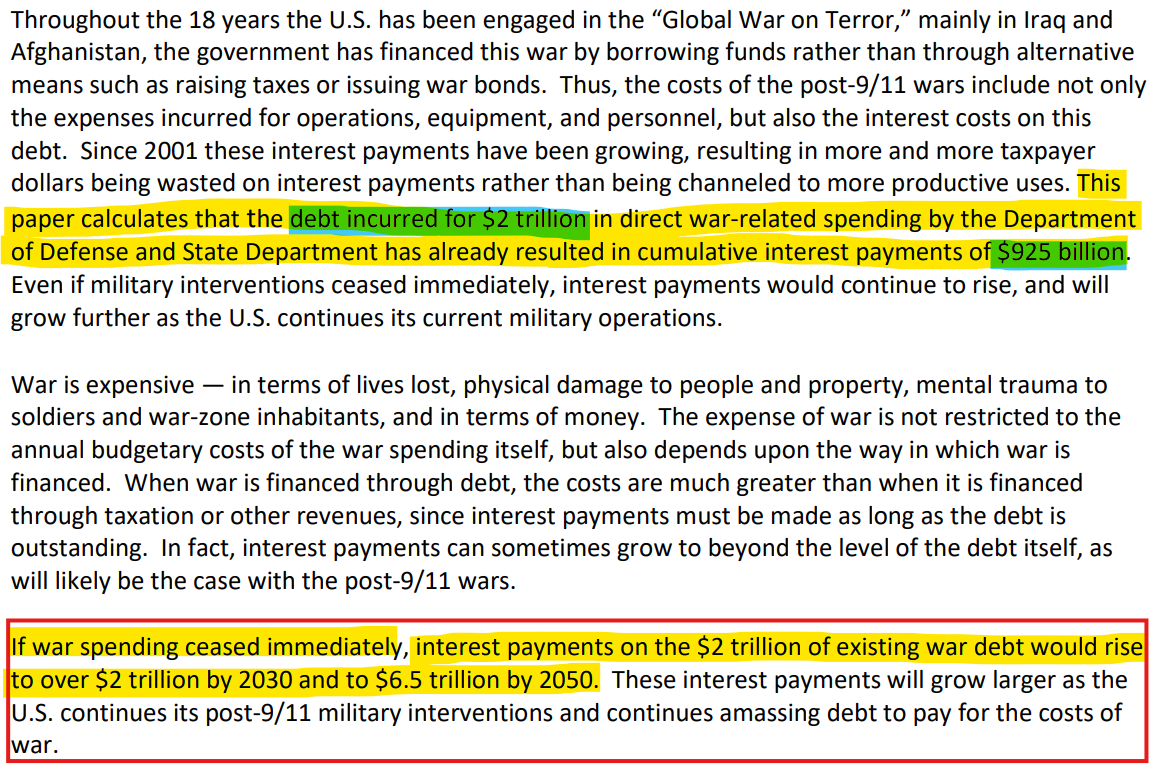

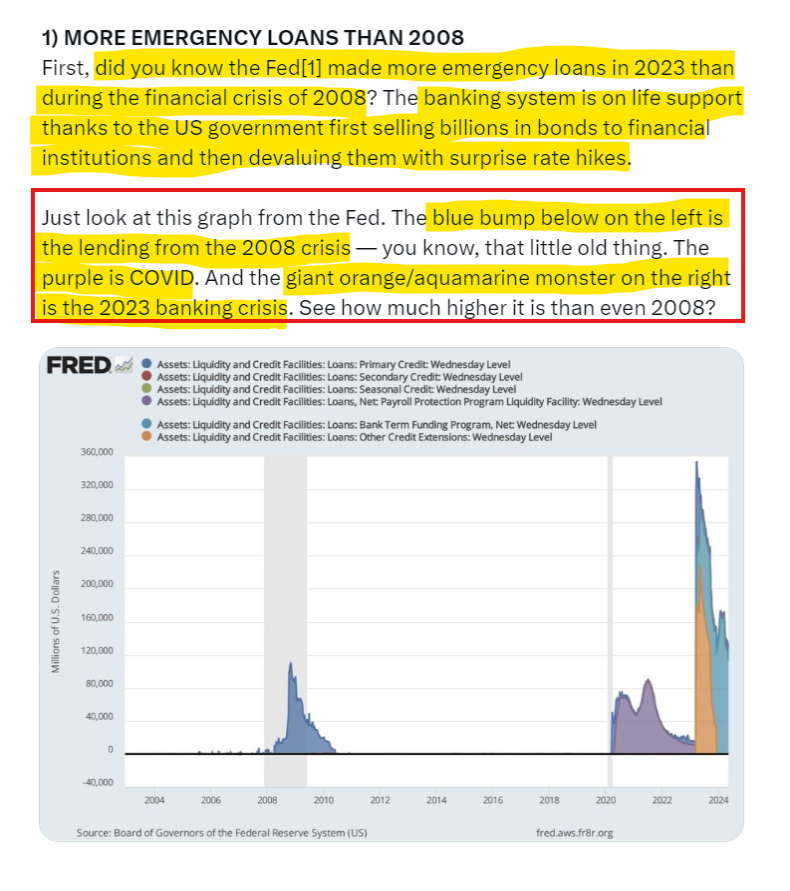

And the cumulative cost of war to the American taxpayers? Interest payments of $6.5 trillion by 2050!!

Here is the pdf document for your records.

That is what the Afghan war gifted to the US.

An unsustainable debt.

Wars/Defense and Debt

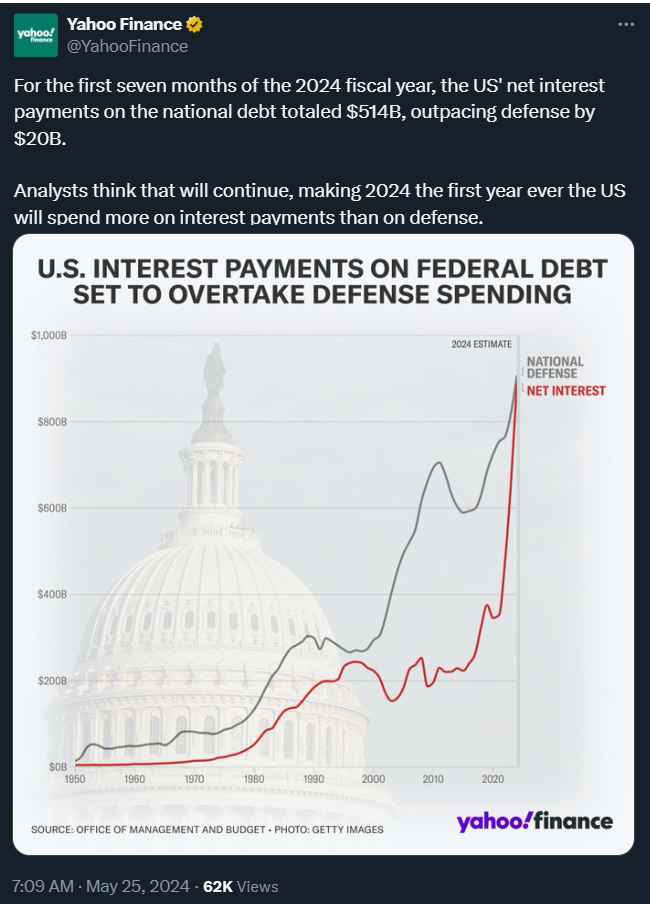

Let us look at the interest payments on the debt that the United States has accumulated over the years.

For the first seven months of the 2024 fiscal year, the US' net interest payments on the national debt totaled $514B, outpacing defense by $20B.

Now wait and think - the latter has fueled the former!

One is caused by the other!!

Where does this lead the United States?

Debt-Interest Deadly Spiral

Read this X post from one of the finest thinkers of our time - Balaji S.

Use of the Emergency loans is the interesting part. Why would they do that?

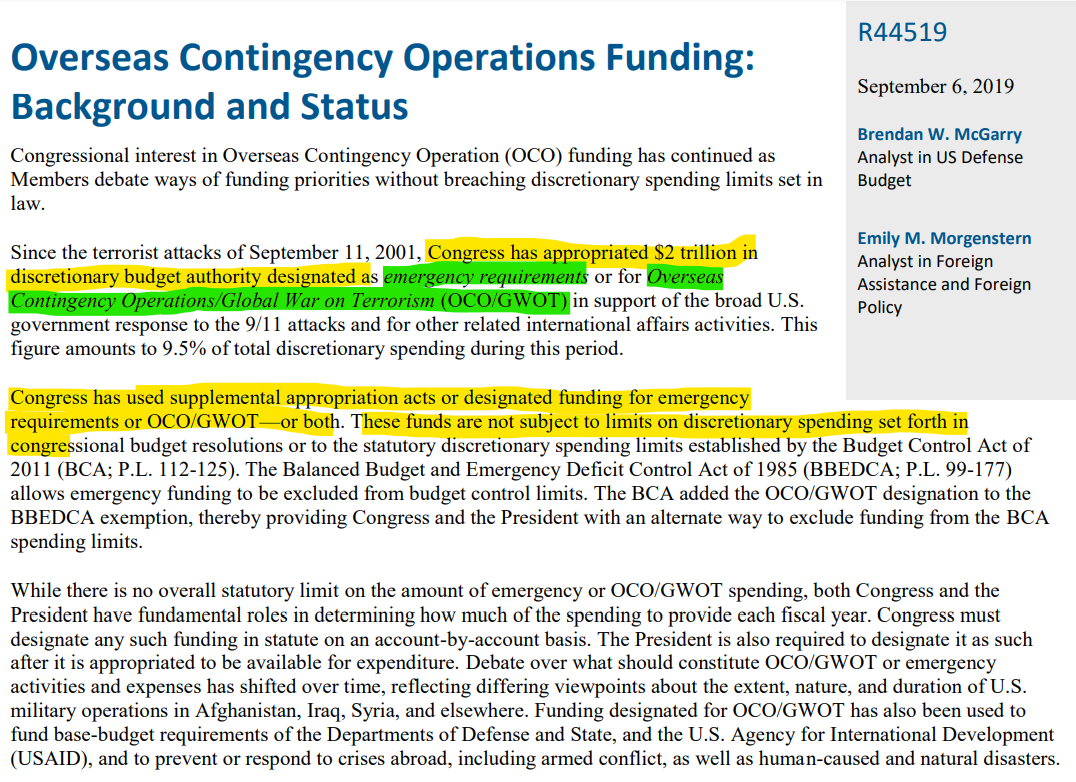

Most of the funds for the Afghanistan and Iraq wars were appropriated using the “emergency” and “contingency” funding that circumvented the normal budget process. The result was that the spending oversight was minimal and it was kept on with the pretense that the wars were "short term" and about to end.

No oversight or roadblock.

A source of "endless money" in the Pentagon and Defense that plunders the American taxpayer to fund the elite.

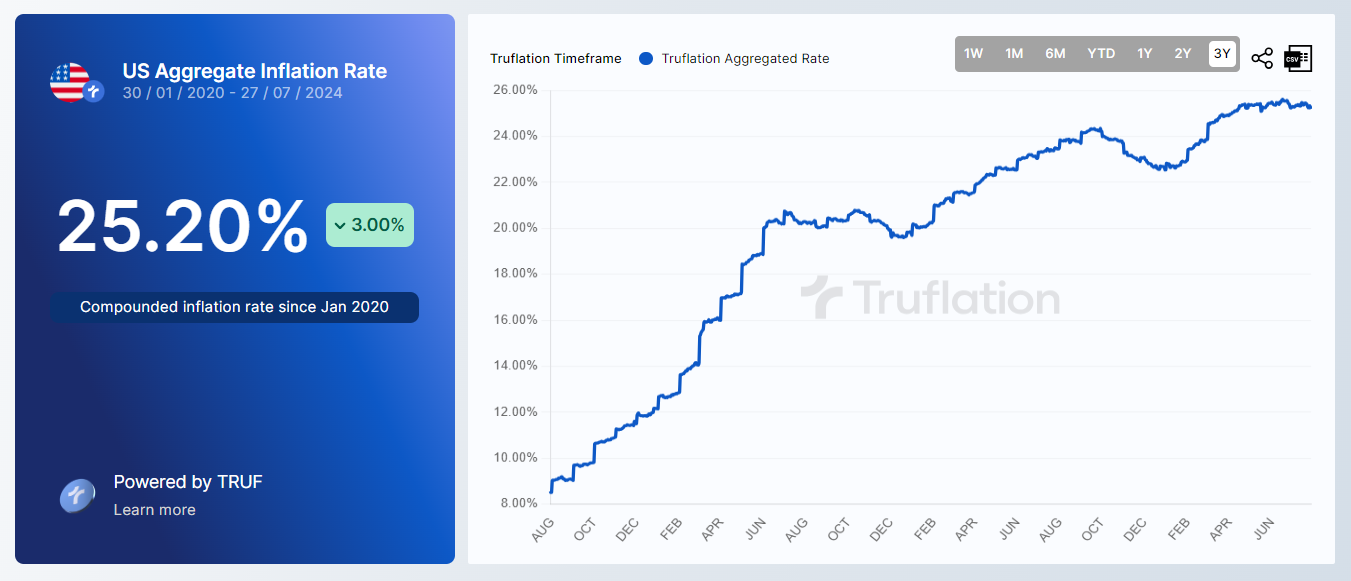

What this has meant for the American taxpayer is crippling inflation. Over 25% in 4 years!

Again, Balaji contextualizes this with data from Larry Summers. This 25% does not include the impact of the hike in interest rates.

But Larry Summers estimates[4b] that purchasing power has been eroded even more radically than this, with annual numbers hitting 18% if you include the enormous spike in loan payments due to rate hikes. Compounded over four years, that’d be considerably more than 25% of the dollar's value. (Source: X Post by Balaji)

What we are looking at is fairly serious.

- BRICS moving away from the Dollar and amassing Gold

- BRICS more powerful than the G-7

- US Debt at an unprecedented level. More importantly, unsustainable levels.

- Defense spending causing loans. Loans interest payments competing with Defense spending in the total annual spending.

Now, let us come to another side.

The geopolitical risks that are manifesting in ways that have a pattern.

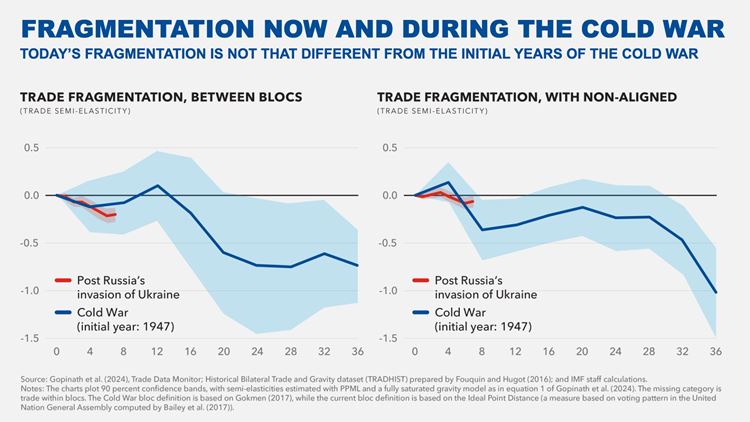

The world is worried about Trade Fragmentation which has caused restrictions as the Geopolitical risks grow.

This is what Gita shares.

Let’s take a closer look at how far we have gone down that route already. New trade restrictions have increased sharply—more than tripling since 2019—while financial sanctions have also expanded. The geopolitical risk index has spiked in 2022 following Russia’s invasion of Ukraine. And private sector concerns about fragmentation—gauged by the number of mentions in corporate earnings calls—have surged. (Source: Geopolitics and its Impact on Global Trade and the Dollar / IMF)

Yes, fragmentation is following a familiar path. A path during the most dangerous time in recent history.

The current fragmentation is looking eerily similar to the Cold War time.

The Ukraine war was a watershed in many ways. it single-handedly impacted Trade Fragmentation.

The scariest thing is that given the animosity that is spiraling - thanks to a profit-seeking military enterprise that has weaponized race, gender, and other differences to its advantage within the West - down the abyss of mutual destruction, the portends point to a dark future for the planet.

Listen to Gita Gopinath's very insightful lecture.

Great insights indeed!

The Unchartered Waters of Amplified Fragmentation

In today's world, trade is the primary channel through which fragmentation could reshape the global economy.

Trade restrictions destroy the efficiency gains that come with specialization, eliminate economies of scale, and decrease competition.

Financial fragmentation also creates costs. As FDI (foreign direct investment) decreases capital accumulation goes down. That hits at capital allocation, asset prices, and eventually the international payment system.

Weaker international risk sharing due to financial fragmentation usually leads to higher macro-financial volatility for individual countries and random and unexpected geopolitical shocks. As we saw earlier, over time geopolitical shocks are leading to greater trade fragmentation because the chasm between nation groups is widening at a rapid pace.

The global payment system is fragmenting along geopolitical lines with new, non-interoperable payment platforms emerging. This will necessarily lead to fragmented standards and regulations.

The stability of such a system would be at risk without strong policy coordination among all reserve currency-issuing countries.

But who will "bell the proverbial cat"? So, going forward, this coordination would become well nigh impossible in a world divided along geopolitical lines.

Essentially, the world is heading into uncharted waters where the impact of every small geopolitical incident could be magnified in a financially and trade-wise fragmented world. That could lead to consequences that are existentially terminal for mankind.

Aside: Multiple Income Streams from the Military Industrial Complex

If you thought that raping the American taxpayer was the only source of income for the Military Industrial Complex, think again!!

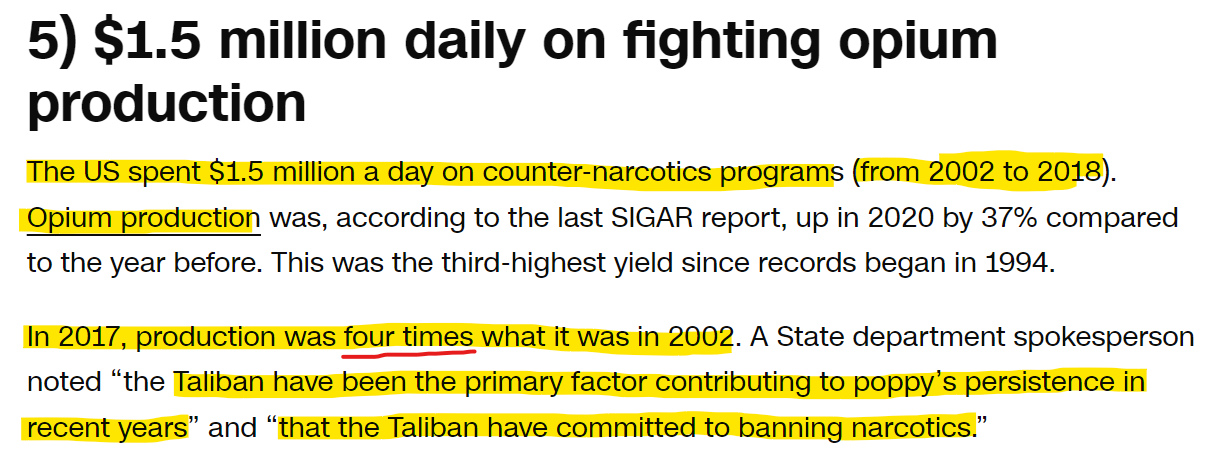

The whole establishment machine - State Department, Pentagon, USAID, Military, and the other NGOs have been backing, funding, and benefitting from the opium trade from Afghanistan.

All of that is funded by - again - the American taxpayer!

The US Government spent $1.5 million a day in "fighting opium production". At least for the rest of us.

But were they? Here is an interesting primer from Brad Pitt's movie "The War Machine". It gives a good tutorial on the process.

When the opium fields were flourishing in Afghanistan during all the years that US troops were making mincemeat of those cities and towns - we were told America was "fighting Afghan opium trade".

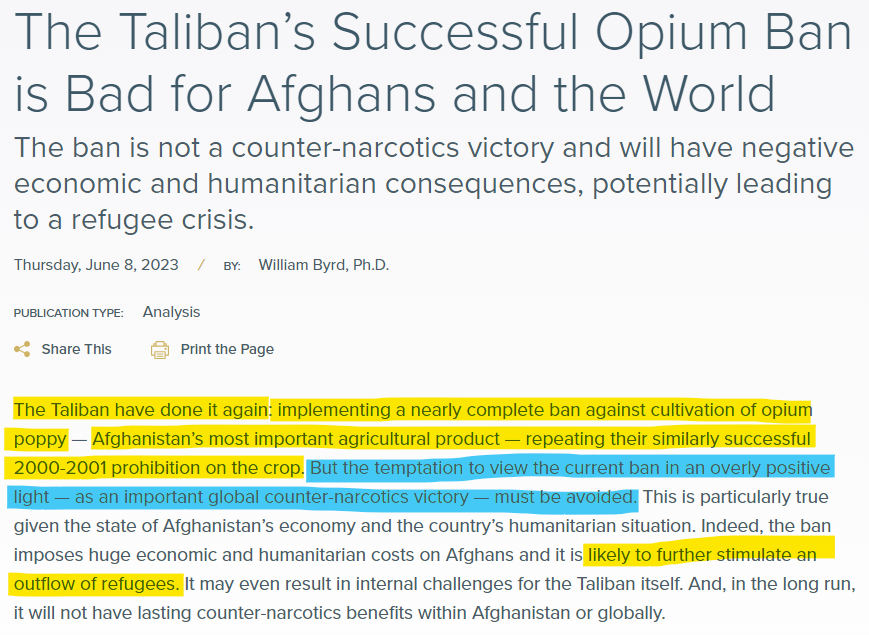

But as soon as the US troops leave and the Taliban takes over, the opium trade is banned and there is a clear victory over the whole production machine from that region.

But for the United States Institute of Peace - with the office next to the State Department - it was all a very bad thing!

Go figure!

And just so you know - this is what the USIP really does per their own followers.

So, while appearances can be kept on, the powerful American (and Western) elites can destroy entire societies riding on the money they plunder from the American taxpayers (including their retirement nest egg - make no mistake Social Security and Medicare are now gone for the coming retirees) to create multiple ways to profit from their various enterprises. And, we have not even started discussing "human trafficking" - yet.

Comments ()