India is winning the NPA war

Modi Government’s Insolvency and Bankruptcy Code (IBC) reform is at the heart of the fight against NPAs that the banks had amassed over UPAs 10 year rule. Even the new Chief Economist of IMF, Gita Gopinath, praised the GST and IBC reforms.

Tata Group’s Bamnipal Steel, (BNPL) – a wholly-owned subsidiary of Tata Steel – has completed the buy out of the debt ridden Bhushan Steel in a Rs 36,400 crores deal with a 72.65% stake. The impact of this was that the lenders almost recovered their principal amount.

“Lenders recovered almost entire principal loan of Bhushan Steel through Rs 36,400 crore transparent bid by Tata Steel and also got 12 per cent stake in the company,”

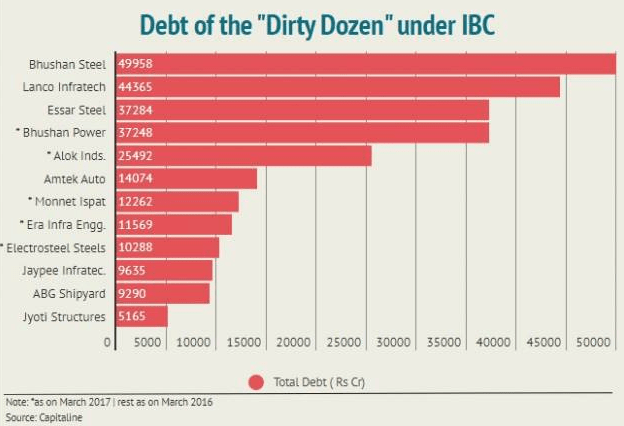

Now VTB-led Numetal has bid for the heavily indebted Essar Steel for Rs 37,000 crore in the second round of bidding! The other bankrupt corporates on the block are – Monnet Ispat and Energy for Rs 12,115 crore and Jaypee Infratech Rs 9,635 crores.

In total, the market is looking at Rs 1 lakh crores of NPAs to be resolved and returned to the creditors. Moneys that the banks had all but lost!

Until now, huge sums have already been recovered. Actually it is the coming together of many legal tools which has enabled such a situation.

In the fiscal ended March 2018, banks recovered Rs 40,400 crore worth of bad loans as against Rs 38,500 crore recovered in FY17. The various channels through which lenders recovered their bad loans include the Insolvency and Bankruptcy Code (IBC), SARFAESI Act, debt recovery tribunals (DRTs) and Lok Adalats.

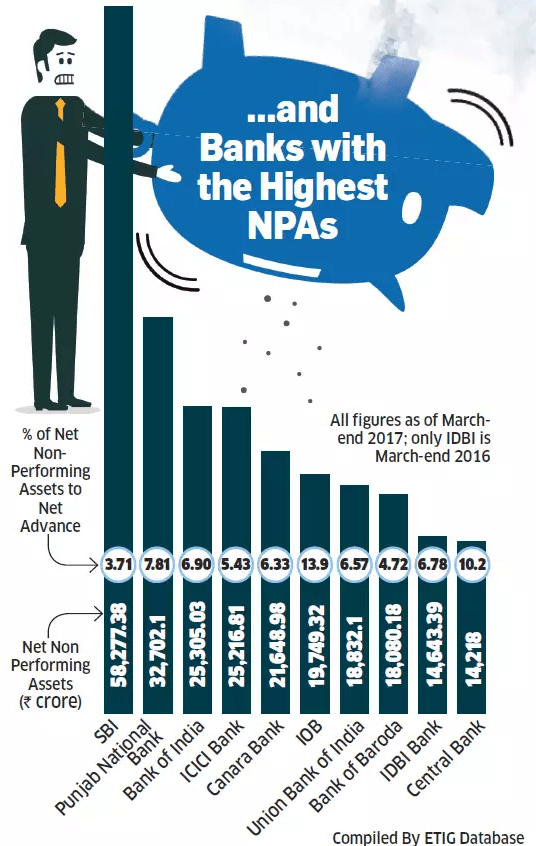

There was a time when thousands of crores were lost by the banks and no one would care. Those losses used to be forever. This is first time in India’s banking history that moneys are coming back to the creditors and bank account holders for their benefit. Here are the banks which have the worst situations.

With this level of bank NPAs over the years look at how bad the situation is. How the government has handled the situation, the country may have a light at the end of the tunnel.

Comments ()