How Tariffs, AI, and Robots Will Reshape Industry and Humanity

Tariffs are breaking old trade ties. AI and robots are rewriting the rules. The U.S.–China split is just the beginning of a new world map drawn in algorithms, not alliances.

The American Society is breaking right through the middle. Wealth inequities are unimaginably high! Rising Debt is putting the global system in peril. Where are we headed?

Once upon a time, there was a renowned Zen master who received an invitation to attend a grand banquet. However, when he arrived at the venue wearing his humble beggar's clothes, the host failed to recognize him and rudely chased him away. Undeterred, the Zen master returned to his home and quickly changed into his exquisite ceremonial robe made of purple brocade.

With his new robe, he made his way back to the banqueting room.

As he entered, the atmosphere shifted and the host, now aware of his presence, greeted him with utmost respect and reverence. The Zen master gracefully removed his magnificent robe and gently placed it on the designated seat.

With a slight smile, he spoke, “I have no doubt, that it is my robe that is expected, as you turned me away from your door when I first arrived,” — and left.

The world of business and economy is full of pretenses.

The robes may hide the real self - of the societies and the economies - but not for long. What is inside - a Zen Master or a Demon - is the real deal.

What does the world of today hide under the purple brocade robe of wealth and power?

What we do takes a lot of work. So, if you like our content and value the work that we are doing, please do consider contributing to our expenses. Choose the USD equivalent amount in your own currency you are comfortable with.

A Big Sort is underway.

Red (Republican) and Blue (Democrat) states are being divided more decisively.

Political polarization has always been there in the US. It is now taking a whole new dimension now, however.

People are "fleeing" - not just moving - states because of the discrimination (perceived and real) that they are facing. Of course, COVID times and the focus on remote work helped tremendously for people to make such lifestyle changes and decisions.

Partisanship became deeper.

America is not just being broken down the middle ideologically. But also geographically!

And the divide doesn't just stop at the geographical divide.

It is going deeper. And, it is being enacted in universities and colleges and spilling over to the towns near those colleges. Deeply red states and towns with "liberal" colleges are now churning out decisively blue results.

These urban centers and cities where the Democrat agenda finds resonance, are seen as a threat by the Republicans. So they are hitting back in Blue states.

From Florida and Mississippi to Georgia, Texas and Missouri, an array of red states are taking aggressive new steps to seize authority over local prosecutors, city policing policies, or both. These range from Georgia legislation that would establish a new statewide commission to discipline or remove local prosecutors, to a Texas bill allowing the state to take control of prosecuting election fraud cases, to moves by Florida Republican Gov. Ron DeSantis and Missouri Republican Attorney General Andrew Bailey to dismiss from office elected county prosecutors who are Democrats, and a Mississippi bill that would allow a state takeover of policing in the capital city of Jackson. (Source: How crime is igniting new conflicts between red states and blue cities / CNN)

While these changes are being done, there is an inherent intolerance for the other person. Democrats have owned the agenda while coopting the media and are setting the narrative.

Wokeism is defining how every event and action by individuals and masses is defined and promoted. January 6th Capitol protests were insurrection and the Tennessee House takeover was a peaceful protest for democratic values.

President Biden invited three Tennessee state legislators, two of them expelled by their colleagues, to the White House to celebrate their alleged courage and decry their supposed victimization. The former consisted of the trio taking over the well of the Tennessee House chamber and leading chants to encourage the mob, which had invaded the body, demanding more gun control after the mass shooting at a Nashville Christian school. The perpetrator, shot dead by police, has been described as transgender. Contrast Mr. Biden’s embrace of leaders of the Tennessee mob with Democrats’ exaggerated outrage over Jan. 6. When it’s against the interests of the Democratic Party, it’s an insurrection. When it furthers its interests, it’s a peaceful protest in defense of democratic values. Within days of the mob action in Tennessee, an antifa/Black Lives Matter gang shut down a speech by Kristan Hawkins — leader of Students for Life of America — at Virginia Commonwealth University. (Source: Democrats are taking us to mob rule / Washington Times)

Who defines and decides who is virtuous?

This divide has larger and deeper ramifications. Ones, that go to the heart of America's prosperity.

As America breaks apart in every sense - ideological, geographical, educational, and moral - things are becoming progressively tough for the coming generations.

Already the American dream is now no more a dream. It is turning into a nightmare.

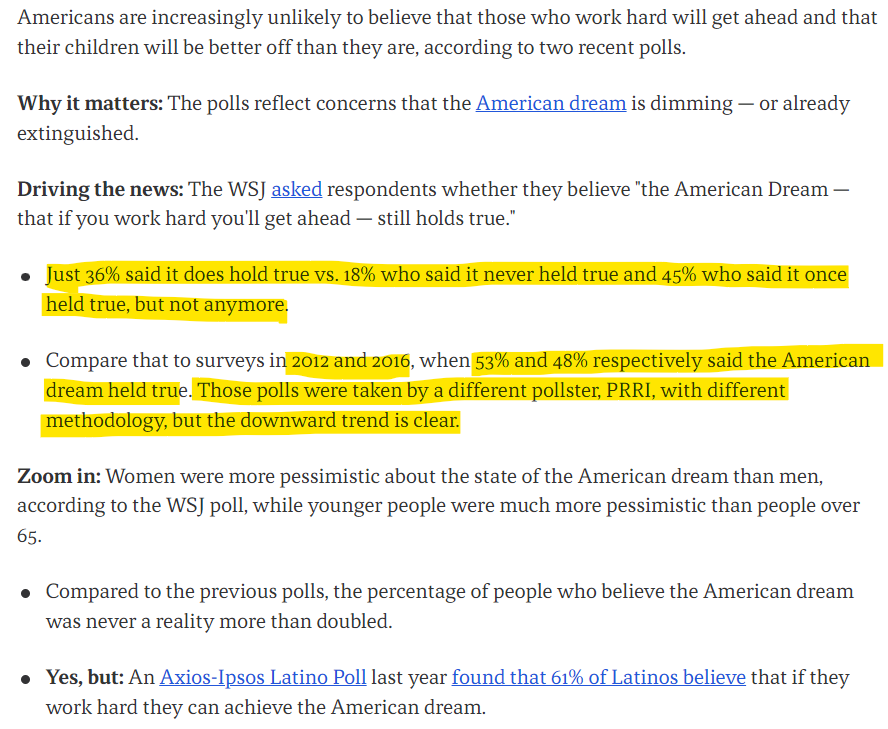

Only 36% of Americans still believe in the American Dream being true. 45% think it once was but it's no longer working, while 18% said it never was true at all. Interestingly 61% of the Latinos believe in the American Dream. So, one would think that the chances of those 36% being largely immigrants believing in the American Dream may be quite high!

The believers in the American Dream have been falling over the past few decades. The drop has been a whopping 32% in just 10 years!

That is significant.

Compared to what the US was like at one time, to what it is now, there is a strong sense of despondency in people. Which is different from how an immigrant coming from a poor country views things.

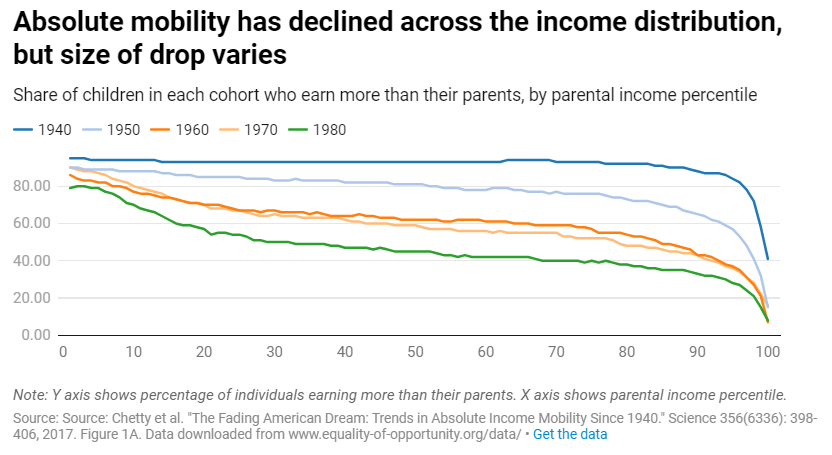

If there is one statistic that best captures the transformation of the American economy over the past half century, it may be this: Of Americans born in 1940, 92 percent went on to earn more than their parents; among those born in 1980, just 50 percent did. Over the course of a few decades, the chances of achieving the American dream went from a near-guarantee to a coin flip. (Source: Why America Abandoned the Greatest Economy in History / MSN/The Atlantic)

In 1940, 92% of Americans went on to earn more than their parents. By 1980, it had fallen to 50%. The decline has been the most profound at higher incomes.

At the lowest levels of income, the difference may not have been much. But for the middle and upper class, the hit has been tremendous.

What does this really say about the American economy?

This is leading to a redistribution of wealth within the US at an unprecedented rate. The political power and the carte blanche to make decisions have been used to horde large amounts of money by the elite. The political class is in bed with the rich few and together they have fixed the game by keeping the masses at each other's throats. At least ideologically.

The mechanism used most effectively to horde wealth has been war.

The taxpayers fund the war and the elite few make money.

How is that even possible?

Except if the wars were never fought to win. But to make money. Wars funded by American taxpayers for the windfall to a few.

You see, an average taxpayer parts with $1087 every year for the Pentagon contractors alone! Of this, roughly $300 goes to the top five largest military contractors. (Source: Ordinary Americans are forced to subsidize the Military Industrial Complex)

We have discussed this in detail in our previous newsletter.

We aren't talking just some hypothetical stuff. There are figures to back the "Great Sucking Sound" of money flowing from the laypeople to the elite.

As Bernie Sanders said in an article in 2022, three multibillionaires own more wealth than the bottom half of American society – 160 million Americans. (Source: The US has a ruling class – and Americans must stand up to it / The Guardian)

Let us get even more specific on how much has been this wealth migration over the years. The figures are astonishing!

The top 1% got nearly all the benefits of growth in the last 45 years! The US has become more inequitable over the years.

This is not some back-of-the-napkin approximation. According to a groundbreaking new working paper by Carter C. Price and Kathryn Edwards of the RAND Corporation, had the more equitable income distributions of the three decades following World War II (1945 through 1974) merely held steady, the aggregate annual income of Americans earning below the 90th percentile would have been $2.5 trillion higher in the year 2018 alone. That is an amount equal to nearly 12 percent of GDP—enough to more than double median income—enough to pay every single working American in the bottom nine deciles an additional $1,144 a month. Every month. Every single year. Price and Edwards calculate that the cumulative tab for our four-decade-long experiment in radical inequality had grown to over $47 trillion from 1975 through 2018. At a recent pace of about $2.5 trillion a year, that number we estimate crossed the $50 trillion mark by early 2020. That’s $50 trillion that would have gone into the paychecks of working Americans had inequality held constant—$50 trillion that would have built a far larger and more prosperous economy—$50 trillion that would have enabled the vast majority of Americans to enter this pandemic far more healthy, resilient, and financially secure. (Source: The Top 1% of Americans Have Taken $50 Trillion From the Bottom 90%—And That's Made the U.S. Less Secure / Time Magazine)

These were the $50 trillion that instead of going to normal Americans' paychecks, were funneled to corporate profits and offshore accounts of the super-rich!

The devastating impact of this redistribution of wealth on ordinary Americans was underscored by the research done by the RAND Corporation in a very granular manner. A person who is earning $35,000/year today should have been earning $61,000/year and one who is earning $72,000 would have made $135,000 - had the redistribution not happened and America was really as fair as its elites pretend it is!

For example, are you a typical Black man earning $35,000 a year? You are being paid at least $26,000 a year less than you would have had income distributions held constant. Are you a college-educated, prime-aged, full-time worker earning $72,000? Depending on the inflation index used (PCE or CPI, respectively), rising inequality is costing you between $48,000 and $63,000 a year. But whatever your race, gender, educational attainment, urbanicity, or income, the data show, if you earn below the 90th percentile, the relentlessly upward redistribution of income since 1975 is coming out of your pocket. (Source: The Top 1% of Americans Have Taken $50 Trillion From the Bottom 90%—And That's Made the U.S. Less Secure / Time Magazine)

This unearned money that wound up in offshore accounts of the elite few have devastated the lives of ordinary Americans.

Unemployment, homelessness, lack of healthcare, the closing of higher education avenues, and lack of medicines.

The list of woes of ordinary Americans keeps growing every year.

In terms of higher education, we should remember that 50 years ago tuition was free or virtually free in major public universities throughout the country. Today, higher education is unaffordable for millions of young people. There are now some 45 million Americans struggling with student debt. Today over 70 million Americans are uninsured or underinsured and millions more are finding it hard to pay for the rising cost of healthcare and prescription drugs, which are more expensive here than anywhere else in the world. The cost of housing is also soaring. Not only are some 600,000 Americans homeless, but nearly 18m households are spending 50% or more of their limited incomes on housing. (Source: The US has a ruling class – and Americans must stand up to it / The Guardian)

It is not just the ordinary Americans that are suffering. The country - the United States of America - is becoming weaker and insecure at a rapid pace.

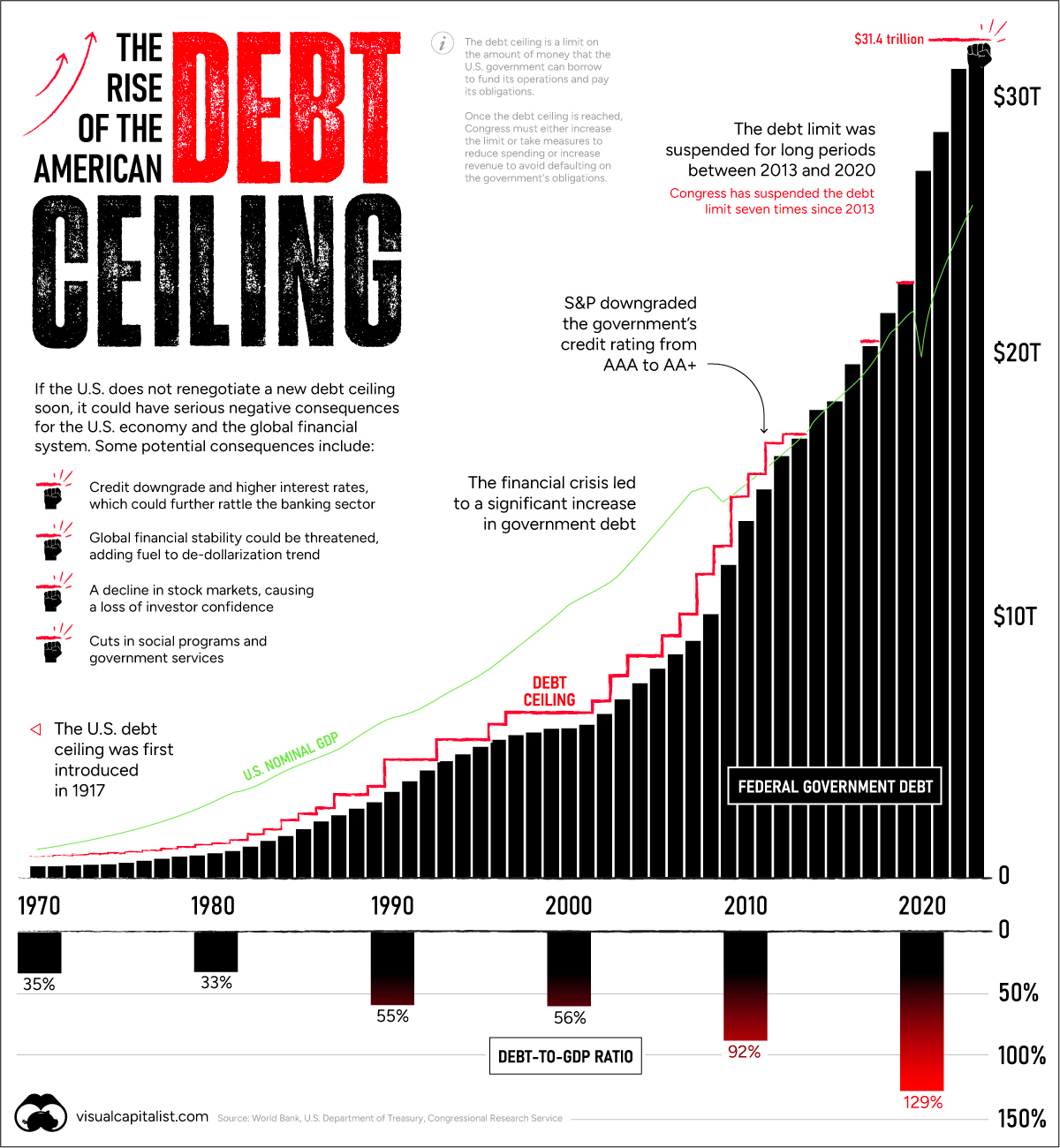

By September 2023, the U.S. national debt had crossed $33 trillion!

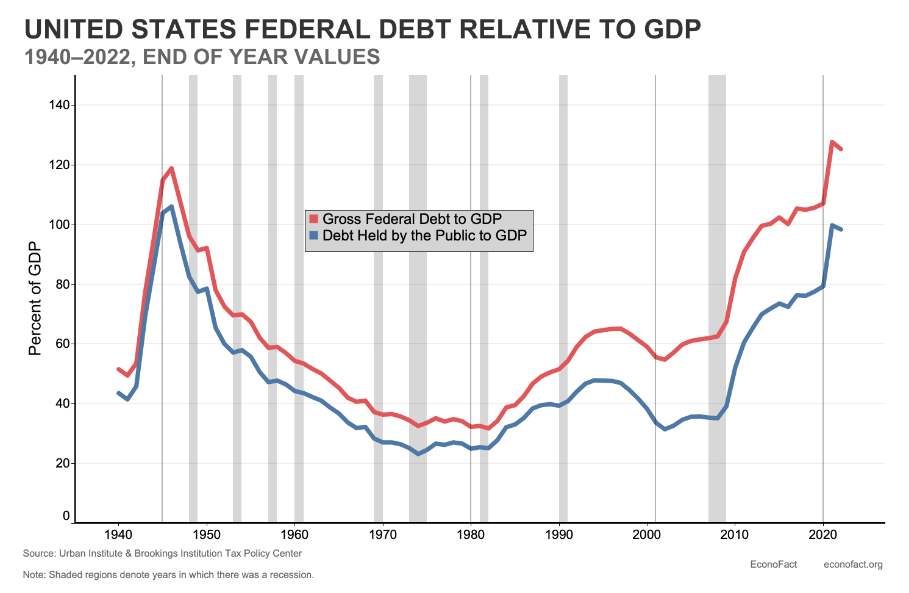

The debt-to-GDP ratio for the debt held by the public is set to top the 100% mark.

The Congressional Budget Office (CBO) forecasts debt held by the public to grow even more over the coming years, to 100.4 percent of GDP in 2024 and 108.9 percent of GDP five years after that. (Source: Why is the U.S. Debt Expected to Keep Growing? / Econofact)

The total debt is another story though.

The Gross Federal Debt to GDP is well over the 100% mark.

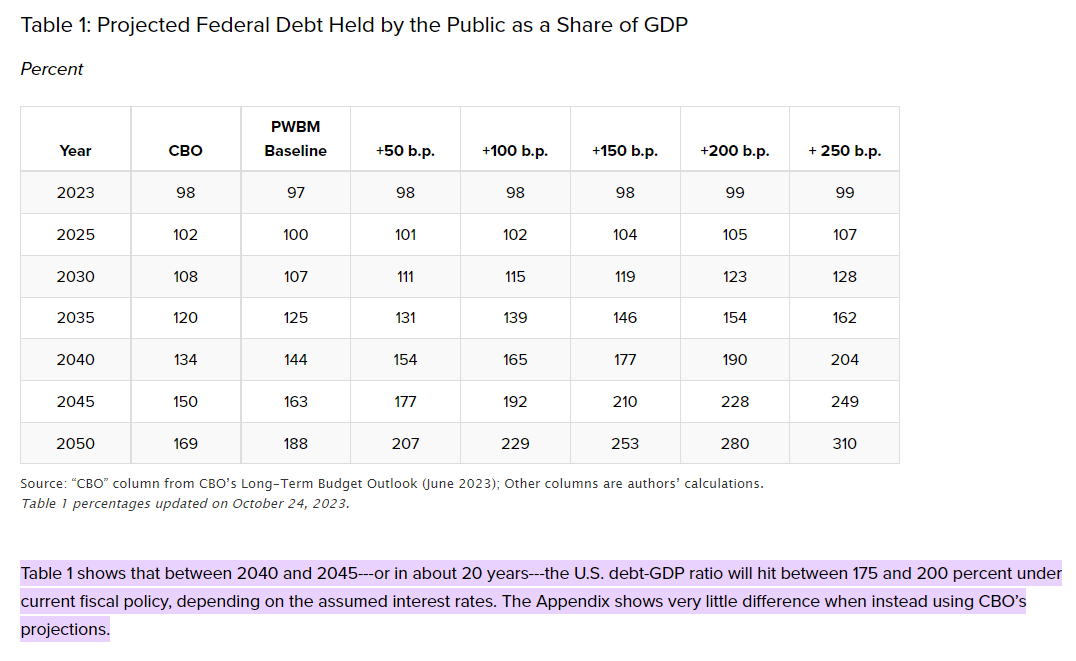

The increase in the debt-to-GDP ratio will not stop anytime soon. In fact, it is expected to go above the 200% mark between 2040 and 2045.

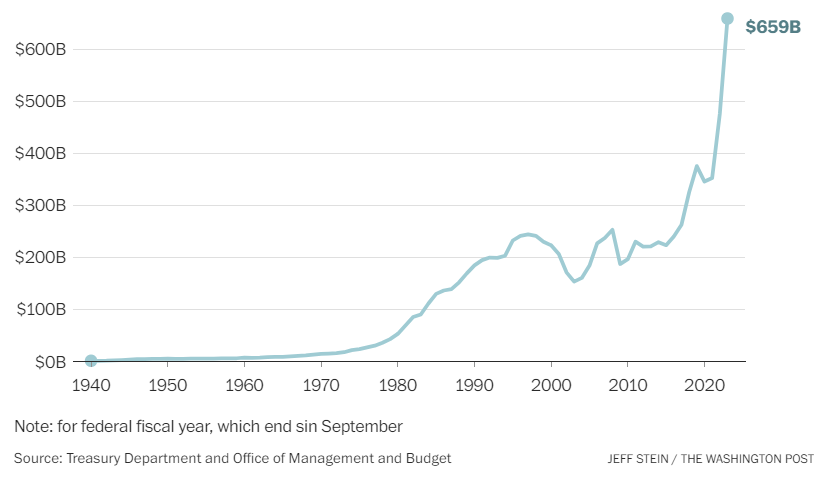

The yearly bill to service the debt is a whopping $659 billion! That was more than on all federal programs for children, including child care, education, and tax credits for families.

This fiscal mismanagement comes with a price. Higher national debt-to-GDP means a higher risk of default and financial panic. On August 1, 2023, Fitch Ratings, one of the country's three major credit rating agencies, announced that it had downgraded the US credit rating from AAA to AA+. (Source: Fitch Ratings)

But this is not just bad for the American economy. It has a big global impact!

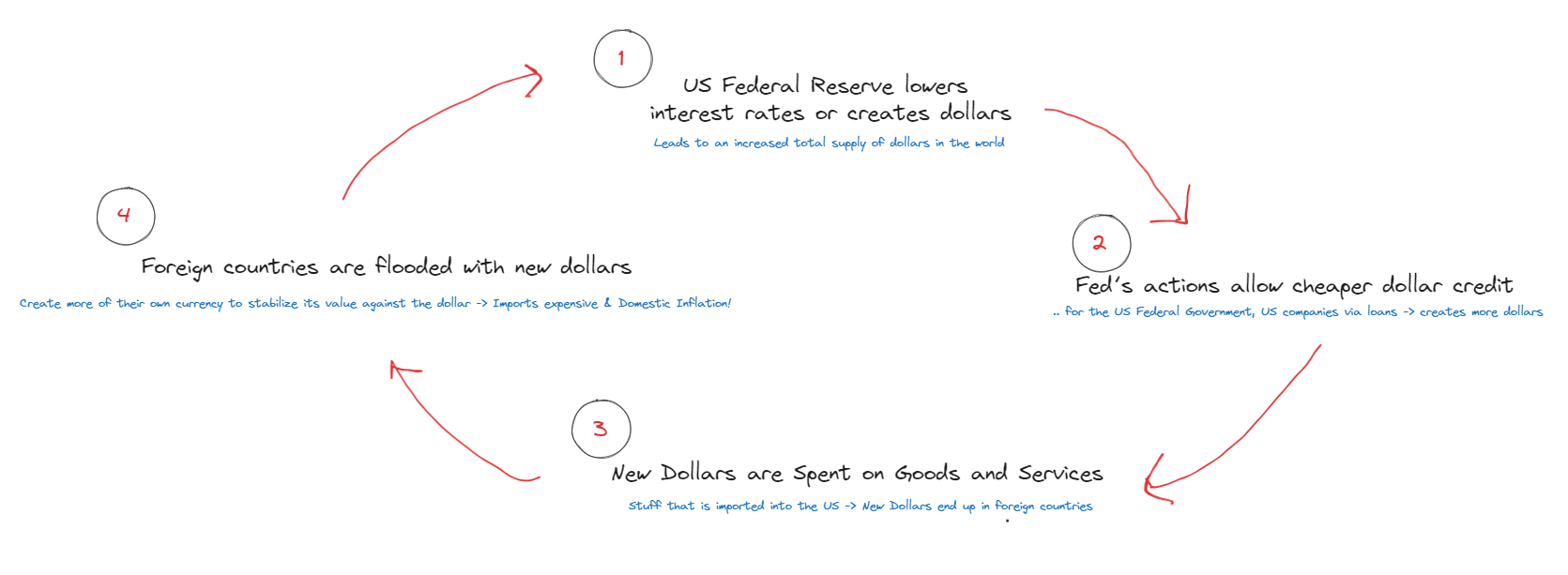

The fact is that the biggest export from the US is Inflation.

As US debt increases and Quantitative Easing tools are used by the US Federal Reserve, the global ramifications start.

For example, when the US Fed decided to raise rates by three-quarters of a percentage point at three consecutive meetings, the Central Banks in Switzerland, the United Kingdom, Norway, Indonesia, South Africa, Taiwan, Nigeria, and the Philippines also followed suit! (Source: CNN)

In the 1980s, the policymakers in the large economies - the US, Japan, Germany, France, and the UK had come together to announce the Plaza Accord. No such luck this time apparently.

The last time the dollar went on a similar tear, in the early 1980s, policymakers in the United States, Japan, Germany, France and the United Kingdom announced a coordinated intervention in currency markets that became known as the Plaza Accord. The dollar’s recent rally, and the ensuing pain it’s caused for other countries, has sparked chatter that it may be time for another agreement. But the White House has thrown cold water on the idea, which makes it look unlikely for now. “I don’t anticipate that that’s where we’re headed,” Brian Deese, the director of the National Economic Council, said Tuesday. In the meantime, the Federal Reserve is expected to stay the course. That means the dollar could yet climb further, and other central banks won’t be able to relax. Additional dollar strength and higher US rates is “absolutely something that we should be anticipating, and the consequences of that are really quite profound,” Ashley of Goldman Sachs Asset Management said. (Source: How the United States is exporting inflation to other countries / CNN)

High interest and high inflation impact the markets in its own ways.

As the interest rate increase brought about by the US Fed's decision, the bond markets are the first ones to be impacted. The bond prices are crashing.

That is what we are witnessing right now.

Today, we are seeing the greatest crash in the bond markets possibly in recorded history. In a Forbes article in 2019, I highlighted the negatively yielding zero coupon bond in Germany where buyers were induced to pay more than par (ensuring a certain loss if held to maturity). That bond was issued at a price of 103.61 (issue yield of -0.11%), and as inflation and yields have surged, the bond’s price has fallen to about 45 (current yield of 3.05%). (Source: The Bond Market Crash – And What One Can Do About It Now / Forbes)

As per the data from Bank Of America, the current fall has led to the worst bond market in the 247-year history of the US.

This rout in the bond market rivals the losses in stocks seen during the 2008 stock-market crash. Remember that the Silicon Valley Bank collapsing in March was also triggered by a massive $1.8 Bn loss on its fixed income portfolio.

Ten-year Treasury notes have plummeted 46% since March 2020, according to data from Bloomberg, while 30-year Treasurys are down 53% over the same period. Stocks last suffered losses of that magnitude 15 years ago, when the collapse of Lehman Brothers and the 2008 financial crisis led to the benchmark S&P 500 index plunging 48% in the space of six months. Investors' belief that the Federal Reserve will hold interest rates at their current level well into 2024 in a bid to kill off inflation has led to bond yields, which move in the opposite direction to prices, soaring over the past two months, with the key 10-year yield approaching 5%. (Source: Long bonds are cratering - with the asset class racking up losses that rival the 2008 stock-market crash / Business Insider)

With the increase in interest rates on the debt accumulated via the US Federal Reserve comes another specter that we may not have imagined earlier.

Central Bank Bailouts!

The rise in the interest rates is now inflicting a price on the US Federal Reserve. The losses in the Federal Reserve have now crossed $100 billion and will double in the next 1-2 years.

Federal Reserve losses breached the $100 billion mark, central bank data released on Thursday showed, and they're likely to go a lot higher before the red ink stops. The U.S. central bank is continuing to pay out more in interest costs than it takes in from the interest it earns on bonds it owns and from the services it provides to the financial sector. While there's considerable uncertainty around how it will all play out, some observers believe Fed losses, which began a year ago, could eventually as much as double before abating. William English, a former top central bank staffer now at Yale University, said he sees a "peak" loss of around $200 billion by 2025. Meanwhile, Derek Tang of forecasting firm LH Meyer said the loss is likely to be between $150 billion and $200 billion by next year. (Source: Fed losses breach $100 billion as interest costs rise / Reuters)

So how does the Federal Reserve take care of its losses? By borrowing more of course. That does a simple thing - shifts the bill to taxpayers by raising the consolidated federal debt.

Taxpayers are bailing out Federal Reserve member banks—institutions that own the stock of the Fed’s 12 district banks—and hardly anyone has noticed. For more than 100 years, our central-banking system has made a profit and reliably remitted funds to the U.S. Treasury. Those days are gone. Sharp rate hikes have made the interest the Fed pays on its deposits and borrowing much higher than the yield it receives on its trillions in long-term investments. Since September 2022, its expenses have greatly exceeded its interest earnings. It has accumulated nearly $93 billion in cash operating losses and made no such remittances. The Fed is able to assess member banks for these losses, but it has instead borrowed to fund them, shifting the bill to taxpayers by raising the consolidated federal debt. That tab is growing larger by the week. Under generally accepted accounting principles, the Fed has $86 billion in negative retained earnings, bringing its total capital to around negative $50 billion. (Source: The New Bank Bailout / Wall Street Journal)

So you see what is happening here? For all practical purposes - this is a Central Bank bailout on the backs of the US taxpayers. Taxpayers are bailing out Federal Reserve member banks. These are the institutions that own the stock of the Fed’s 12 district banks.

Four of the 12 Federal member district banks are insolvent! 5th may become insolvent soon.

And taxpayers are paying for every one of those.

Each of the Fed’s 12 district banks, except Atlanta, has suffered large operating losses. Accumulated operating losses in the New York, Chicago, Dallas and Richmond, Va., district banks have more than consumed their capital, making each deeply insolvent. A fifth district bank, Boston, is teetering on insolvency. At the current rate of loss, five others will face insolvency within a year and the taxpayers’ bill will grow by more than $9 billion a month until interest rates decline or the Fed imposes a capital call or assessments on its member banks. (Source: The New Bank Bailout / Wall Street Journal)

No one called this bailout but that is what it was. All done quietly and surreptitiously! A pain that does not seem like ending anytime soon.

This is not just an American phenomenon.

Bank of England is in no better position. The rise in interest rates and the consequent fall in gilt (UK government bonds - akin to Treasury Bonds in the US) prices have led to greater losses!

The Bank of England’s losses on bonds bought to shore up the U.K. economy after the financial crisis will be “materially higher than projected until the middle of the decade,” according to Deutsche Bank. In late July, the central bank estimated that it would require the U.K. Treasury to backstop £150 billion ($189 billion) of losses on its asset purchase facility (APF). The program ran from 2009 to 2022 and was designed to improve financing conditions for companies hit by the 2008 financial crisis. It saw the BOE accrue £895 billion worth of bond holdings while interest rates were historically low. (Source: The Bank of England is facing major losses on its bond purchases — and it’s set to get much worse / CNBC)

The interest rates have been hiked in 14 consecutive monetary policy meetings - from 0.1% in 2021 to a 15-year high of 5.25% now. It is expected to rise further. Simply put - the pain is not going to get over any time soon.

Bundesbank - the German Central Bank is also a victim of Quantitative Easing.

Germany’s federal audit office has warned the Bundesbank may need a bailout to cover losses arising from the European Central Bank’s bond-buying scheme, potentially throwing a spanner in the ECB’s plans to carry out similar programmes in the future. “The possible Bundesbank losses are substantial and could necessitate a recapitalisation of the [bank] with budgetary funds,” said the report by the audit office, the Bundesrechnungshof, which has been seen by the Financial Times. Purchasing vast amounts of bonds to lower borrowing costs, known as quantitative easing, has long been controversial in Germany. The Bundesbank argued against it in 2015, when the eurozone’s central bank launched its bond buying, but it was outvoted at the ECB. The audit office’s criticisms are likely to make a repeat of the policy more difficult, especially as some economists blame QE for stoking the recent wave of inflation. (Source: Bundesbank may need recapitalisation to cover bond-buying losses / Financial Times)

Sveriges Riksbank (or Riksbank in short) is the central bank of Sweden. It needs a bailout too!

Sweden’s central bank will need more than $7 billion to cover losses stemming from its quantitative easing programs, the governor of the Riksbank told lawmakers on Tuesday. The bank needs a capital injection of almost 80 billion Swedish kronor ($7.3 billion) just to restore its equity to a basic level, according to preliminary results of an analysis of its financial position, Erik Thedeen told the parliament’s Committee on Finance, according to a statement. (Source: Sweden’s Central Bank Needs More Than $7 Billion to Cover Losses / Bloomberg)

The Europeans tend to be "politically correct" and try to couch their failures in hifalutin semantics to obfuscate their failures. But no matter what they call it - capital injection or covering losses.

It is a plain and simple bailout.

A bailout of the entire monetary and financial system. By the taxpayers.

Ray Dalio is an American billionaire investor and hedge fund manager. He has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985.

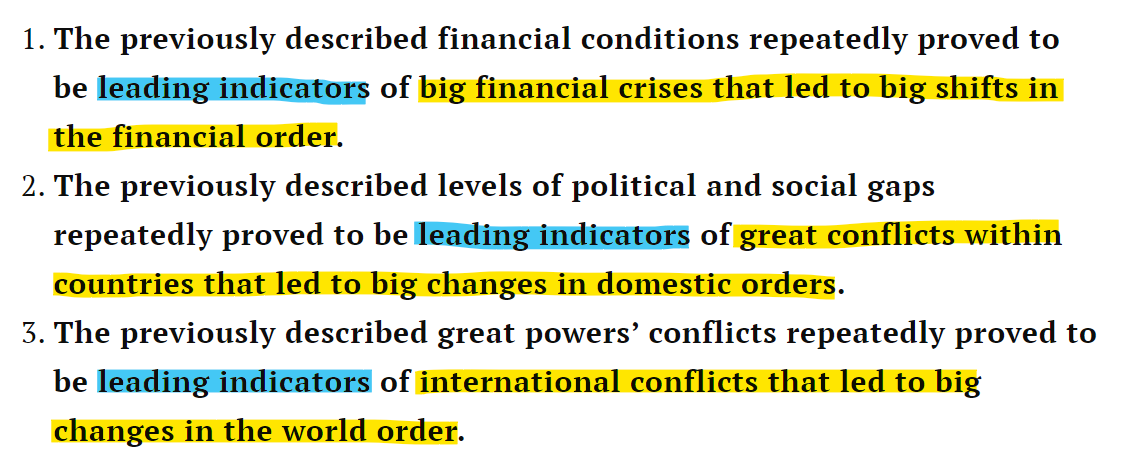

Dalio has identified three trends that will be very significant in the changing global order in the coming years. (Source: Why the World Is on the Brink of Great Disorder / Time Magazine)

What does this mean?

That the three cycles - Debt, Internal Conflict, and External Conflict - will reinforce each other and create one "Big Cycle".

These are, Ray says, Leading Indicators of the greater crises in the future.

Whether the world will see the same cycle and events that unfolded in the 1930s and 40s or not is yet to be seen. But we at Drishtikone have been predicting a similar set of eventualities recently.

Normal minds cannot understand the Dharmic traditions or its ways. It takes a different level of understanding of life to fully grasp the depth and intricacies of something like, say, devotion itself.

The Kottankulangara Devi Temple in Kollam, Kerala, has an interesting celebration - called the Chamayavilakku festival.

Thousands of male devotees come up dressed as women.

This festival is a sacred offering to the goddess Bhagavathy and is part of a ritual to seek her blessings.

The men who dress as women are called "Velichappadu" or oracles. They light lamps in the temple and offer prayers. The festival takes place on Meenam 10 and 11 every year.

The work that goes on into making the transformation is elaborate - men get their eyebrows done, apply makeup, and dress up in colorful saris. To make their appearance as authentic as possible, they also shave off their mustaches.

The festival is celebrated every year in March for 19 days. On the last two days, men wear glittering jewelry and intricate makeup, donning saris for the "Kottankulangara Chamayavilakku" ceremony.

This is done as an offering to the Goddess in gratitude for granting their prayers.

Some of these men are so convincingly feminine that it can be difficult to recognize them as men in women's clothing.

Ananth Rupanagudi, an Indian Railways officer, recently shared information on Twitter by sharing a photo of a man dressed in women's clothing during the Chamayavilakku festival.

The Devi Temple in Kottamkulakara in Kollam district in Kerala has a tradition called the Chamayavilakku festival.

— Ananth Rupanagudi (@Ananth_IRAS) March 27, 2023

This festival is celebrated by men who are dressed as women. The above picture is that of the man who won the first prize for the make up In the contest. #festival pic.twitter.com/ow6lAREahD

A video from the festival also went viral. You can check it out here.