How Tariffs, AI, and Robots Will Reshape Industry and Humanity

Tariffs are breaking old trade ties. AI and robots are rewriting the rules. The U.S.–China split is just the beginning of a new world map drawn in algorithms, not alliances.

What is the India Stack? What are its power and game-changing capabilities? How is it at the cusp of a global geopolitical shift? Get all your answers here.

An Open architecture, when done at scale, almost always results in the public good. For-Profit efforts at some point pose the question of greater control for their originators.

The same is the difference between spiritual efforts and religions.

No one knows who really wrote the Vedas and numerous other scriptures in the Hindu tradition. The act of writing was not important. The experience and the understanding that prompted it was not the work of one woman or man. It was a collective experience. That is why there is a consistent thread.

Religions, on the other hand, have a fountainhead and certain straitjacketed proprietary manuals. They have been used for profit, power, and control.

It is the nature of things.

Some years back, India embarked on a larger exercise of creating identification for each citizen. Whatever may have been the intent then, the turnaround of that effort into an open stack that challenges every notion of work, finance, social interaction, and disaster management is not just unique.

It is spectacularly game-changing.

Suddenly we are looking over the cliff and seeing how the world as we knew it will no longer be the same.

And, with that, comes the need for sagacity and wisdom to hold forth what has been unleashed. There will be many who want to destroy, damage, control, and undermine this. Usurp it and contaminate it with their private power structures even.

That should not happen.

Let us first understand what is the India Stack.

It is not just any technology framework, it is built at scale.

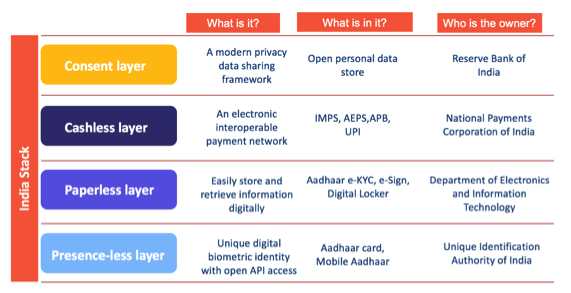

It consists of four layers:

Each layer has a clear technology rationale, infrastructure, and components to go with it.

It is a great way to build the infrastructure for the future.

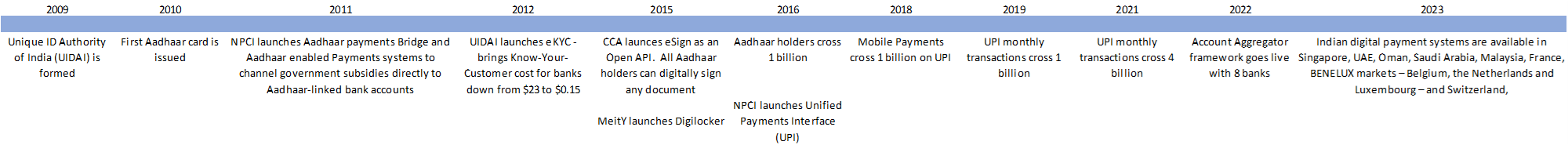

Here is a timeline of the main events which have happened on the road to creating the India Stack.

The economy and its power have been growing manifold in the last 10 years because of the efforts taken to integrate many aspects of the India stack, bringing in the financial inclusion of even the poorest in the land.

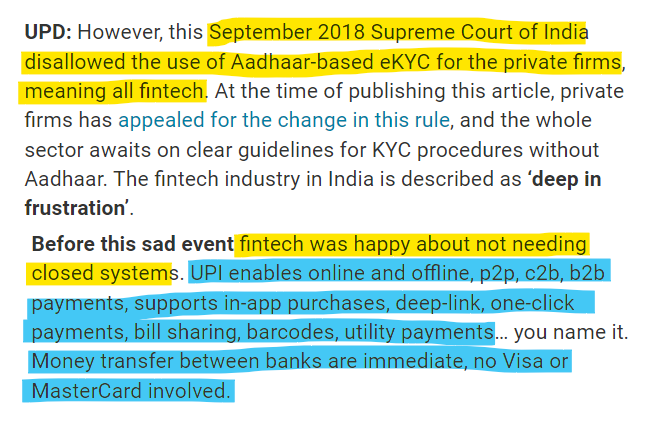

Just as the India Stack was taking off, the Indian Supreme Court came in with its infinite wisdom to hold back the economy yet again.

The Supreme Court of India put in the biggest dampener to this extraordinary effort. (Source: September 26, 2018 judgment)

A day after the damning verdict by Supreme Court, the then finance and the law ministers came out with their own interpretations.

Barely a day after the Supreme Court had delivered its decision, the Union Finance Minister, Arun Jaitley, and the Union Minister for Electronics and Information Technology as well as Law and Justice, Ravishankar Prasad, said that the Supreme Court’s reading down of section 57 related only to contracts. In this regard, the Ministers are correct. But this is the letter, not the spirit of the Supreme Court’s decision. Section 57 states that: “Nothing contained in this Act shall prevent the use of Aadhaar number for establishing the identity of an individual for any purpose, whether by the State or any body corporate or person, pursuant to any law, for the time being in force, or any contract to this effect: Provided that the use of Aadhaar number under this section shall be subject to the procedure and obligations under section 8 and Chapter VI.” (Source: Aadhaar is Creeping Back Despite Supreme Court’s Judgement / NewsClick)

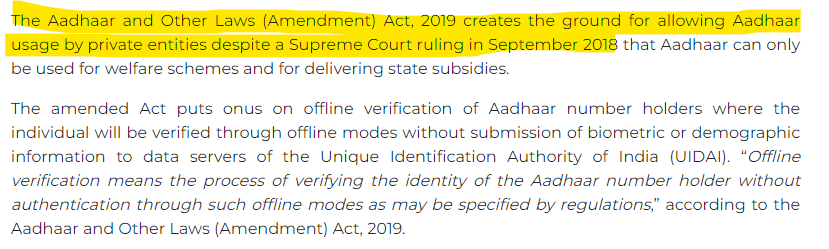

There was one workaround that the Supreme Court verdict provided for.

...that the use of Aadhar has to be backed by law.

That law was the Aadhaar and Other Laws (Amendment) Bill, 2019

The new 2019 bill, therefore, provided creative ways to circumvent the mess created by the short-sighted Supreme Court judgment in September 2018. By adhering to the letter (if not the "spirit") the private sector gained access to UIDAI’s authentication infrastructure.

It's the authentication that really makes the whole India Stack work!

The banks knew... the auditors knew and the customers understood.

Despite Indian Supreme Court's inexplicable ways, everyone pretended to be "following" its verdict, without really caring for its asinine provisions that made no sense in the new digital world!

When a Moneycontrol reporter visited Canara Bank’s Goregaon East branch in Mumbai, a senior official insisted on a photocopy of the Aadhaar card to open a savings bank account. When the reporter cited the Supreme Court’s judgment and the Reserve Bank of India’s (RBI) Know Your Customer (KYC) rules, the official still said Aadhaar was mandatory. “The auditor gives an ‘unsatisfactory’ remark that the e-KYC for opening an account is not complete without an Aadhaar card,” the official said in an irritated tone. It’s not an isolated instance. Branches of state-run banks like Central Bank of India in sector 37 of Noida, Bank of Baroda’s in Goregaon East and Indian Overseas Bank’s in Jameen Pallavaram, Chennai, also had officials insisting on a photocopy of the Aadhaar card to open savings bank accounts or take loans despite the customers not using government subsidies. (Source: "The Aadhaar confusion | Four years on, some banks yet to honour Supreme Court’s Aadhaar verdict" / Moneycontrol)

At the highest levels and official circles, the banks and lawyers say that the practices in the bank branches and on the ground are due to "ignorance" and "lack of awareness", the truth is that there is a great Indian way of doing what is needed despite the stupidity of the governing elite. Act ignorant and move on.

Such an attitude becomes more a comment on the elite's disconnect from the ground than about the common man's disconnect from the laws of the land!

The world was, however, planning for what the India Stack was already on its way to mastering.

LIBRA was a blockchain-based stablecoin payment system launched by Facebook's parent company Meta Platforms in 2020.

The idea was great.

So two reasons why Facebook wanted to start this cryptocurrency:

Before we discuss this further, check this past post to understand the deep links and "revolving door" between American Social Media giants and the intelligence agencies like the FBI and CIA.

The target market was unorganized and not accessible via the normal means of social media or other tools.

This was the time when India's own stack was coming of age.

LIBRA - which was renamed Diem - held great promise to disrupt the global financial mechanism and processes.

In its initial days, Dr. Philipp Sandner, the head of the Frankfurt School Blockchain Center shared what Libra meant for the world of finance.

Libra could become a global payment platform that can bring a broad array of existing currencies on a blockchain system. It would make multiple currencies “programmable” and easily transferable end-to-end within a couple of seconds. If the Libra technology would be implemented in popular smartphone apps such as Whatsapp, sending money would be as easy as sending an image via Whatsapp around the globe. An example would be a money transfer from a Swiss citizen to a person in Argentina within a couple of seconds at close-to-zero transaction costs. If such a money transfer would be done via Whatsapp it would bypass the existing financial system. Yet, this requires currencies to be plugged onto the Libra platform and individuals (or companies) to be onboarded. The former requires compliance with regulatory frameworks and the latter an integration for example in Facebook’s apps spanning hundreds millions of people. (Source: Crypto Finance Corporation)

Well, eventually, Libra was closed down!

Libra was a cryptocurrency created by Facebook, renamed into Diem at the end of December 2020 and wound down in January 2022. The Libra cryptocurrency was intended to be used as a simple, low-fee global blockchain-based digital currency. (Source: Corporate Finance Institute)

One of the main reasons was - Central Banks, specifically in Western countries were terrified of this new system.

So the overlay systems that layer on top of the normal fiat-money underlying network core are expensive and less efficient.

Well, the India Stack solved that issue by joining Aadhaar - a security biometric system; and UPI - a payment system that is interoperable.

So customers could move money between different payment services and banks easily. While doing so, it also provided an opportunity for the fintech and big-tech interfaces to become the overlay!

What makes the UPI system and the India stack even more powerful is that it is being integrated with other countries making it seamless to transact across borders by using UPI.

Indian digital payment systems are available in Singapore, UAE, Oman, Saudi Arabia, Malaysia, France, BENELUX markets – Belgium, the Netherlands and Luxembourg – and Switzerland, among others. It is also understood that India has signed MoUs with 13 countries that want to adopt the UPI interface for digital payments. (Source: India Briefing)

Other countries realize the strength of the India Stack, specifically the combination of the Aadhaar and UPI combination. Unlike the Indian Supreme Court.

Because the world sees the need to have a foundational ID in place, some efforts have been made to leverage the Indian experience.

In 2018, the quest for creating an ID system to tag every person on the globe was undertaken after the Indian example of Aadhaar made waves across the world. The World Bank first approached the government for the Aadhaar framework but the Indian government did not share it since it was proprietary. It then went to the International Institute of Information Technology-Bangalore (IIIT-B) to create a system similar to Aadhaar.

Modular Open Source Identity Platform (MOSIP) was born out of that engagement.

Governments across the world are exploring ways to develop a multipurpose foundational ID system in which individuals receive a unique identifier that they can use for identity assertion and verification. This is where the Modular Open Source Identity Platform (MOSIP) comes in. The MOSIP story began when the World Bank approached the International Institute of Information Technology-Bangalore (IIIT-B), a technology university in Bengaluru, for an open-source foundational identity system on which national IDs could be built. MOSIP is a modular and open-source identity platform that helps user organisations such as governments implement a digital, foundational ID in a cost-effective manner. So far, more than 71.7 million people are registered on MOSIP-based systems across the globe. (Source: A foundational ID system to give identity to millions across the globe / Economic Times)

It would be interesting to note, however, as to who is funding this foundational ID project. The ubiquitous Bill Gates and Omidyar Network.

I leave it to the readers to think about how these "philanthropists" would use such technology.

The power of the India Stack is that it offers open APIs for public digital infrastructure.

So things like BharatPay, BBPS, Aadhar, AEPS, eKYC, eSign, DigiLocker, FASTag, and the GSTN platform are all built on top of those Open APIs.

The India Stack has also enabled the government to launch many ambitious and transforming initiatives in the social space. The efforts and the results are truly spectacular. Here are the most important ones.

E-Sanjeevani - a doctor-to-doctor telemedicine system, is being implemented under the Ayushman Bharat Centre for Health and Wellness (AB-HWCs) program. As we speak, over 15000 hubs have been established, 220k providers have been onboarded and around 93 million patients have been served.

Unified Mobile Application for New-age Governance (UMANG) is a single platform for all Indian Citizens to access pan India e-Gov services ranging from Central to Local Government bodies like Atak Pension Yojana, Ayushman Bharat, Bharat Billpay, etc (Check here for all services) This platform has enabled transactions worth INR 3.5 Billion!

National Digital Education Architecture (NDEAR) is federated, unbundled, interoperable, inclusive, accessible, and evolving which aims to create and deliver diverse, relevant, contextual, innovative solutions that benefit students, teachers, parents, communities, and administrators and result in timely implementation of policy goals. The platform offers over 5 billion learning sessions, and 1500+ courses and has over 20,000 participants.

Digital Infrastructure for Knowledge Sharing (DIKSHA) is a national platform for school education, an initiative of the National Council for Education Research and Training (NCERT), Ministry of Education. This platform has close to 10,000 courses with 167 million enrollments.

Covid Vaccine Intelligence Network (CoWIN) is an Indian government web portal for COVID-19 vaccination registration, enabling interaction with participating healthcare providers, and receiving digital lab reports, prescriptions, and diagnoses seamlessly. As if now 2.2 Billion vaccination doses have been administered.

And now to the next new chapter in the India Stack journey.

The credit demand from the micro small and medium enterprises (MSMEs) that is unmet (or the credit gap) is about $250 billion.

That is around 10% of India's GDP!

The MSME sector accounts for 30% of India's GDP growth. But only 11% of the MSMEs have access to formal credit.

Do you see the humongous opportunity waiting to be tapped to pitchfork India's economy ahead?

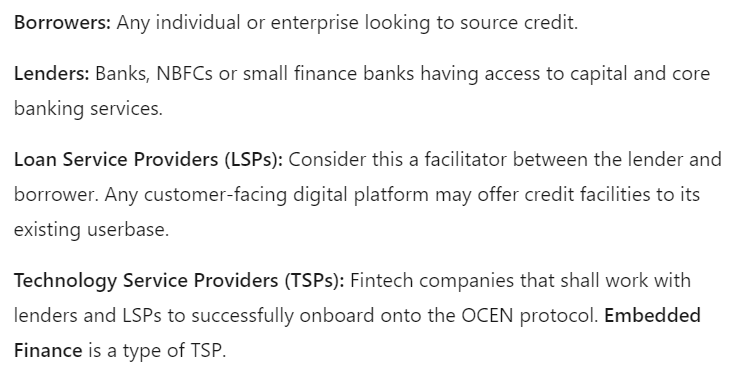

Enter OCEN. Pronounced o-ken.

It's a creation by iSPIRT, a non-profit think tank that also spearheaded the implementation of Aadhar and UPI.

So what is OCEN?

Let us start with what it is not. It is not a product or a service.

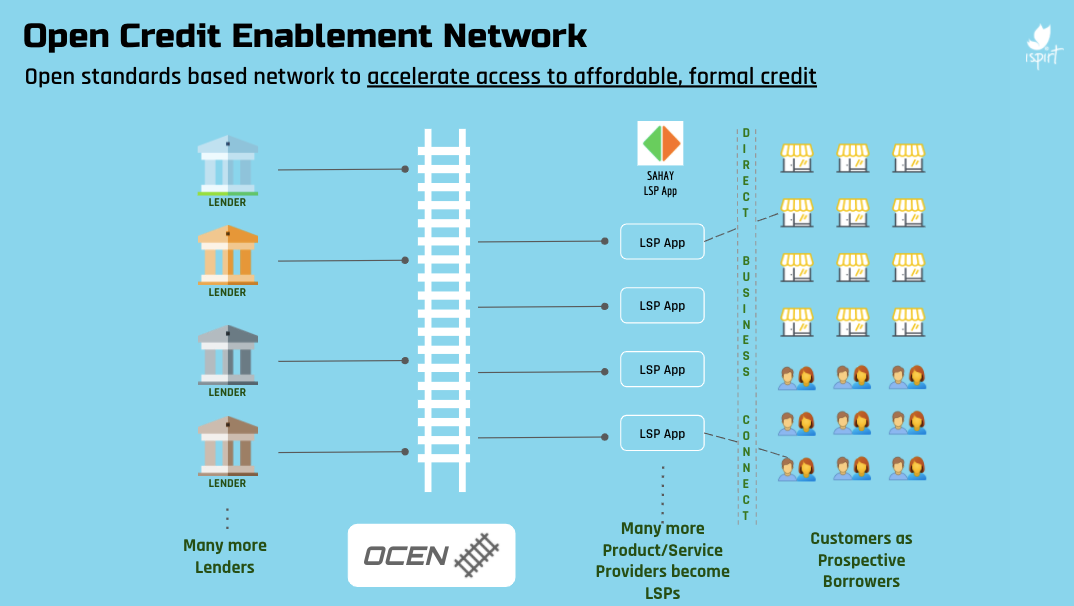

It is a set of standards. Standards that enable integration, collaboration and interaction within the lending value chain.

OCEN comprises Open APIs that help in every step of the lending cycle.

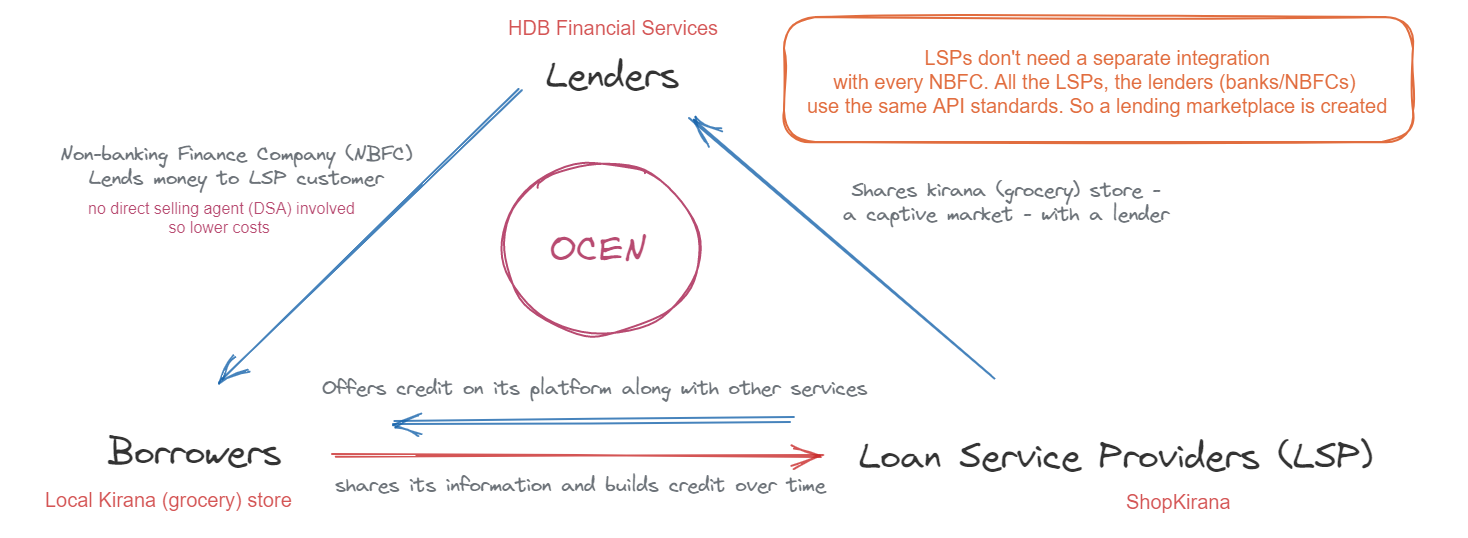

The whole ecosystem is run with the seamless integration of four main participants.

So how does it work practically?

If you have a reasonably large distribution network that also enables you to get reliable and important commercial and financial data from your customers, you can also start a lending operation. And offer credit to your customers who will find it a valuable addition and this will make your relationship sticky.

So instead of one integration at a time, OCEN makes the integration between any organization with the lenders a standard integration. No one needs to guess the other's APIs/systems/standards anymore.

Everyone is on one standard.

The OCEN standard.

Instead of a world full of chaotic networks and unorganized small business owners, India now has one large marketplace.

To say that OCEN itself can single-handedly push the Indian economy to the next level will not be an exaggeration.

India is increasingly using the Rupee to settle

The big one was with Russia, of course.

Alexander Mikheev, Director General of Russia's state arms exporter, Rosoboronexport, announced, on Tuesday, that Russia and India have abandoned the use of the US dollar in mutual settlements, with all payments made in rubles and rupees. Mikheev told reporters in New Delhi, "By tradition, we name all transactions in dollars for ease of calculation. In real work, Rosoboronexport has moved away almost 100% from settlements in the US currency. As for India, all settlements are carried out in rubles and rupees. In addition, we are actively practicing offset projects, which are also present in the contracts signed today. This is normal modern practice, one of the trends in the world market.” (Source: "Russia, India abandon US dollar in mutual settlements" / Al Mayadeen)

Early this year in Jan 2023, India was using its currency to settle the trade in non-oil commodities.

One tool that is going to give a further push is the SVRA (special Vostro Rupee Accounts) model.

Having facilitated rupee trade with Russia, Mauritius and Sri Lanka, the government has asked trade bodies and banks to explore such opportunities with more nations, sources said. Indian banks have already opened special vostro rupee accounts (SVRA) with banks of these three nations, operationalising the rupee trade arrangement. Recently, SBI Mauritius Ltd and People's Bank of Sri Lanka opened an SVRA with State Bank of India (SBI). In addition, Bank of Ceylon opened an account in its Indian subsidiary in Chennai. Union Bank of India has opened special rupee account of Ros Bank Russia while Chennai-based Indian Bank has opened such accounts of three Sri Lankan banks, including Colombo-based NDB Bank and Seylan Bank. In all 18 such special rupee accounts have been opened by 11 banks, including 2 of Russia and one of Sri Lanka, following approval from the Reserve Bank of India (RBI). The RBI issued detailed guidelines on cross-border trade transactions in the domestic currency in July. (Source: Govt Asks Trade Bodies, Banks To Explore More Countries For Trade In Rupee / Outlook)

What does all this mean in global terms?

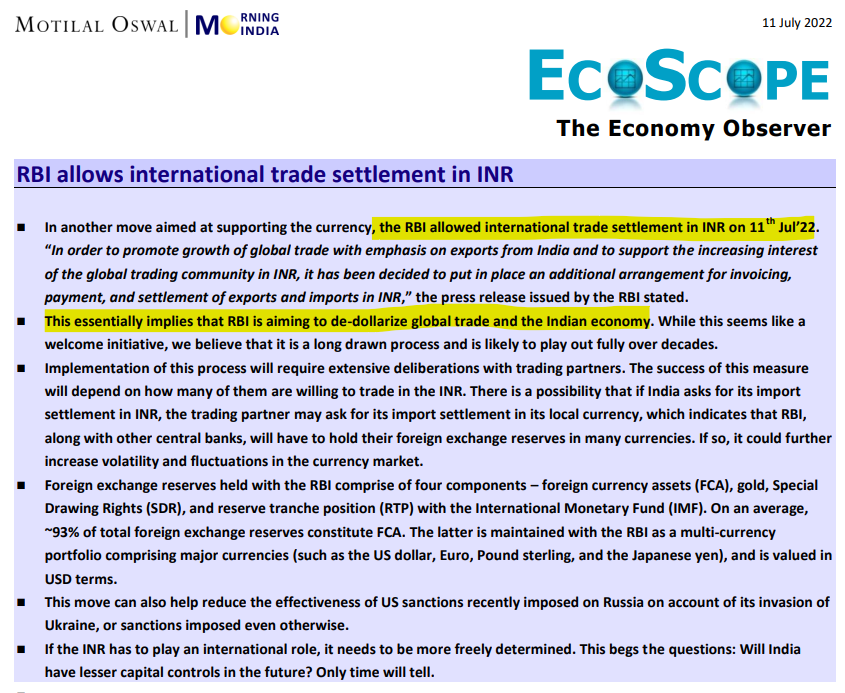

Dr. Ankit Shah shares his views on the combination of India's move to settle in Rupees on the one hand, and the forward march of the India Stack on the other. Combined, these two things will push de-dollarization faster.

Motilal Oswal Financial Services report in 2022 echoed the same sentiment, though more cautiously.

That is interesting.

In the new financial world where the power shift seems imminent, the India Stack can be the fulcrum on which the might of the US Dollar will be challenged.

This will not go down unchallenged.

And, that is what needs to be watched out for.

The questions that mystics ask of us and push us to ponder upon sometimes hit the artists as well. This short but interesting animation looks at those questions somewhat.

Where us I end and Us start? Where does my experience merge with those of countless others? Including the ones who have gone by in the past.

When you are in a long-term relationship, you sometimes feel you are no longer an individual but a part of a super-organism. Between your daily routine, the decisions you make, the music you hear and the air you breathe – it’s hard to tell the difference between "my" choices and "our" choices. The vulnerable and moving voiceover of actress Molly Ringwald tells the story of a couple who have gone through such a long journey together that they can no longer determine where one ends and the other begins.

It's a short one - just about 7 mins.

If you like our content and value the work that we are doing, please do consider contributing to our expenses. CHOOSE THE USD EQUIVALENT AMOUNT you are comfortable with.

If you like this post - please share it with someone who will appreciate the information shared in this edition.

Today’s ONLINE PAPER: Check out today’s “The Drishtikone Daily” edition. - THE DRISHTIKONE DAILY