The Tariff Earthquake: How Trump’s Trade Reset Is Reshaping the World Order

What if a trade policy wasn’t just about economics—but about resetting the entire global power structure? Trump’s 2025 tariffs are doing just that. We look at the strategies, and hidden levers behind this economic disruption—and explore what it means for the world.

― Milan Kundera, Farewell Waltz

In 1453, as the sun set over the Bosphorus, Constantinople fell.

The thundering cannons of Mehmed II penetrated the ancient walls and destroyed an empire.

For over a thousand years, Constantinople (modern-day Istanbul) had stood as the seat of the Byzantine Empire, the eastern half of the Roman Empire. It was strategically perched between Europe and Asia and served as a center of trade, knowledge, and Christianity.

When Mehmed II, the 21-year-old Ottoman Sultan, finally breached its walls with gunpowder cannons—a revolutionary military technology—the last remnants of the Roman Empire crumbled.

But this wasn't just a conquest. It was a trigger.

The Ottomans—young, powerful, and shrewd—tightened their grip on the Silk Road.

They had a radical solution for those who traveled that route - Trade Tariffs!

A millennia-old artery of wealth and spice, now gated by empire. Caravans from India and China were bled with tariffs.

European merchants, especially the rising powers in Venice and Genoa, were badly hit. They could no longer afford the East.

So they turned.

South, around Africa. West, into the unknown. The Portuguese, chasing spices, rounded the Cape of Good Hope. The Spanish, desperate for gold, funded a mad Genoese sailor named Columbus. In their greed to escape Ottoman tariffs, Europe discovered the world.

This tariff—this act of economic assertion—shattered the medieval world order.

- Trade Routes Collapse → Age of Exploration Begins: The Ottomans now controlled all land trade routes to Asia, levying heavy taxes on European merchants. In response, Western European powers—particularly Portugal and Spain—sought new maritime routes to India and the East.

- The Rise of Gunpowder Empires: The Ottoman conquest proved the power of gunpowder artillery in breaking down even the strongest walls. This shifted military architecture and warfare permanently. It inspired the formation and expansion of gunpowder empires like the Mughals, Safavids, and Ottomans

- Creation of Nation States: European kingdoms modernized armies, leading to the militarization of nation-states.

- Migration of Greek Scholars → European Renaissance: Greek Orthodox scholars and intellectuals fled westward to Italy with ancient Greek and Roman manuscripts—some long lost to the West. These texts helped spark the Renaissance, reviving classical learning, art,and science.

- Orthodox Church Shifted to Moscow: With Constantinople gone and the Eastern Roman Emperor dead, Moscow began positioning itself as the "Third Rome"—the new center of Orthodox Christianity. This laid the foundation of the Russian Empire to come later as well.

New maps were drawn.

New empires born. Africa was carved. India fell.

The Americas were ravaged. But it began with Mehmed’s levy.

A tollgate that squeezed the old and birthed the modern. The sea, once a boundary, became the new Silk Road. Gunpowder empires rose. Colonialism dawned.

Ironically, while Constantinople thought it had secured its power, it had set in motion the very forces that would later eclipse it. Europe's maritime empires—sparked by a tax—would become the new giants.

So you see, sometimes, history doesn’t pivot with swords or treaties, but with a tax ledger. A toll on trade. A price on spice. A tariff that forced kings to gamble on oceans.

And the world was never the same.

SUPPORT DRISHTIKONE

In an increasingly complex and shifting world, thoughtful analysis is rare and essential. At Drishtikone, we dedicate hundreds of dollars and hours each month to producing deep, independent insights on geopolitics, culture, and global trends. Our work is rigorous, fearless, and free from advertising and external influence, sustained solely by the support of readers like you. For over two decades, Drishtikone has remained a one-person labor of commitment: no staff, no corporate funding — just a deep belief in the importance of perspective, truth, and analysis. If our work helps you better understand the forces shaping our world, we invite you to support it with your contribution by subscribing to the paid version or a one-time gift. Your support directly fuels independent thinking. To contribute, choose the USD equivalent amount you are comfortable with in your own currency. You can head to the Contribute page and use Stripe or PayPal to make a contribution.

The Tariff Earthquake

The world is in turmoil. The US President announced the landmark tariffs on countries of origin for goods and services across the world. It wasn't just one or two countries that were being targeted. The list included everyone with reciprocal tariffs.

US President Donald Trump has sent shockwaves around the world, and in the US too, with his announcement of reciprocal tariffs on major world economies. Starting April 5, 2025, the United States shall enforce a uniform 10% duty on all incoming foreign goods. And from April 9, America will transition to a matching tariff framework, applying import levies equal to those charged by other nations on American exports. For Indian goods, this translates to a 26% duty, which aligns with rates for the EU (20%) and Japan (25%). However, these figures remain considerably below the rates set for China (54%), Vietnam (46%), Sri Lanka (44%), and Bangladesh (37%). Global markets are in shock and turmoil - and the big question is - will the global economy plunge into recession with Trump’s trade war? (Source: Donald Trump’s reciprocal tariffs send global shockwaves, but India may be among least vulnerable / Times of India)

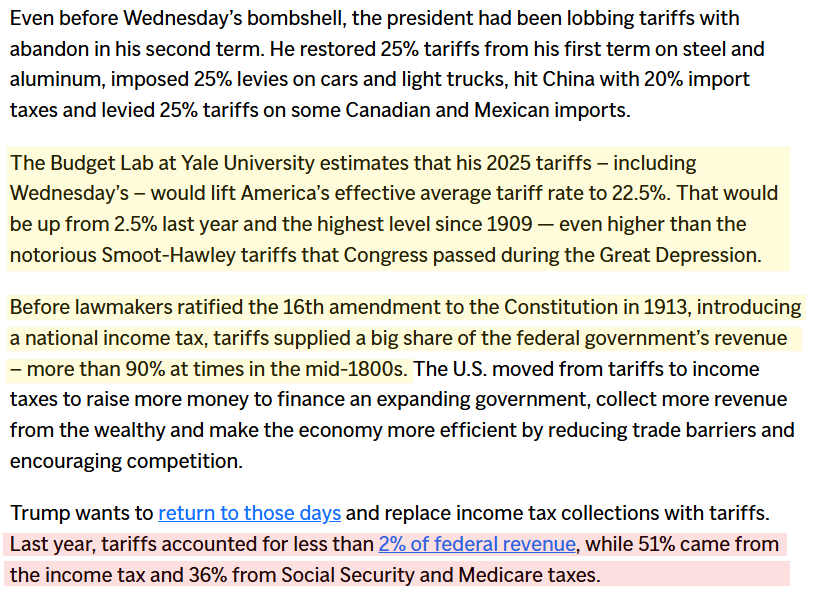

This kind of action may not have happened in the US since the early part of the 20th century.

The Yale Budget Lab further projects, in the article shared above, the impact of these tariffs to include the following:

- Reduce U.S. GDP growth by 0.9 percentage points in 2025

- Trigger a negative multiplier effect through:

- $3,800 annual household purchasing power loss

- 17% clothing price spikes from textile tariffs

- Corporate profit declines at Target and Best Buy

The Best Buy CEO, Corie Barry discusses the impact in these words. This statement brings out the complexities of what the businesses are going to face now. The Supply Chains are highly global and interconnected. They will be decimated.

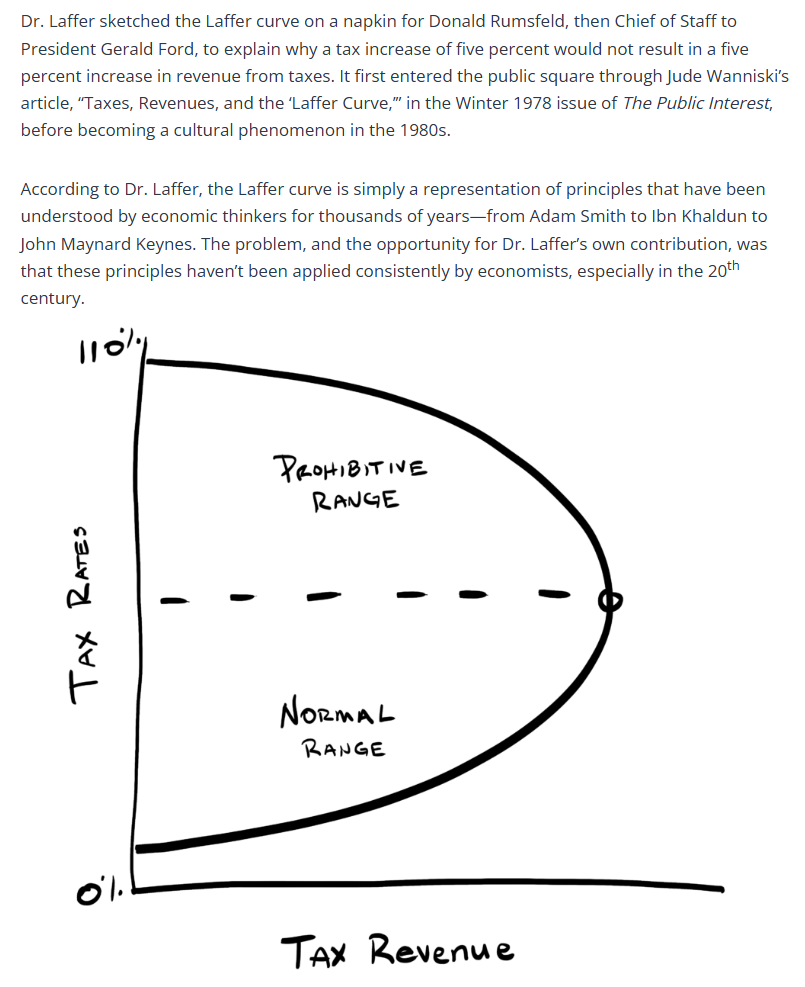

The administration's claim that tariffs could replace income taxes invokes Laffer Curve logic. What is this Laffer Curve?

The argument from the administration could face practical hurdles:

- Current tariffs generate <2% of federal revenue vs 51% from income taxes

- Price increases counteract any theoretical supply-side benefits through reduced consumer spending

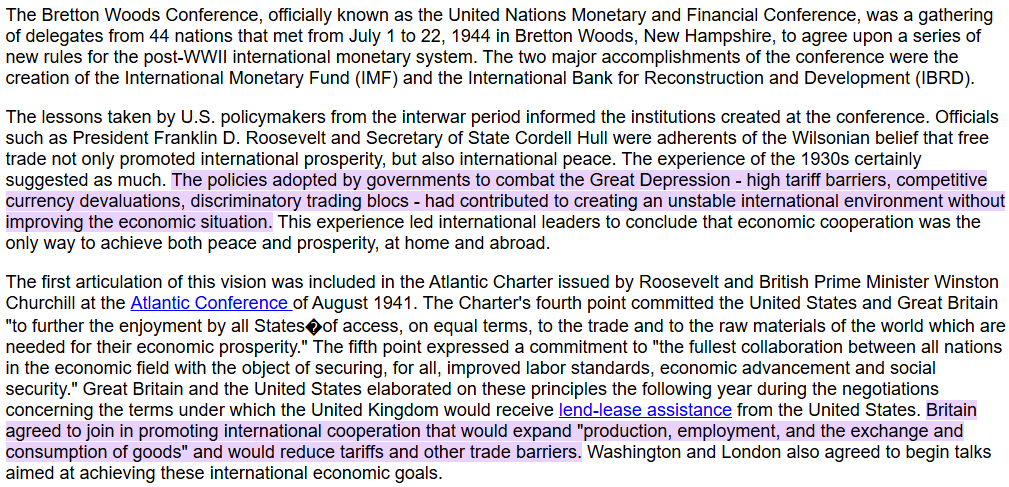

If you look at the developing situation, the current scenario mirrors 1930s protectionism that deepened the Great Depression. Most theories agree the policies risk stagflation - rising prices coupled with slowed growth.

What does this mean for the world?

It is a very fundamental shift in the global (which was and has been essentially an American) world order. In and of itself, it may be more fundamental than the Ukraine war.

Are Tariffs the New Sanctions?

Sanctions have been used as tools of war by the United States and the West for quite some time.

But sanctions are precise—they target few actors/groups/companies. Broadening their reach requires diplomatic maneuvers, which is why their efficacy falters.

But tariffs? They hit broad swaths of another country’s economy. It's almost as if the tariffs punch entire economies in the gut.

They don’t just target specific villains — they squeeze exporters, rattle supply chains, and send shockwaves through political corridors.

The use, power, efficacy, and intended consequences of sanctions do not fully justify their use anymore. Backfire: How Sanctions Reshape the World Against U.S. Interests", author Agathe Demarais shares the message that we all knew but somehow missed the US establishment.

The sanctions do not work! Worse, they push the global community to a point where adversaries may gang up to find alternative ways to evade those sanctions.

Sanctions have become the go-to foreign policy tool for the United States. Coercive economic measures such as trade tariffs, financial penalties, and export controls affect large numbers of companies and states across the globe. Some of these penalties target nonstate actors, such as Colombian drug cartels and Islamist terror groups; others apply to entire countries, including North Korea, Iran, and Russia. U.S. policy makers see sanctions as a low-cost tactic, but in reality these measures often fail to achieve their intended goals—and their potent side effects can even harm American interests. Backfire explores the surprising ways sanctions affect multinational companies, governments, and ultimately millions of people around the world. Drawing on interviews with experts, policy makers, and people in sanctioned countries, Agathe Demarais examines the unintended consequences of the use of sanctions as a diplomatic weapon. The proliferation of sanctions spurs efforts to evade them, as states and firms seek ways to circumvent U.S. penalties. This is only part of the story. Sanctions also reshape relations between countries, pushing governments that are at odds with the U.S. closer to each other—or, increasingly, to Russia and China. (Source: Backfire review / Columbia University Press)

What sanctions would do earlier, tariffs are designed to do now.

President Trump is wielding tariffs not just for economic goals, but as a tactical lever in diplomacy. The pattern so far indicates that tariffs and tariff threats are being used to pressure countries into broader concessions (on issues ranging from trade imbalances to immigration and security matters). For example, in the Western Hemisphere, the administration announced steep 25% tariffs on Mexico and Canada shortly after taking office – only to suspend or delay those tariffs within weeks

The tariffs weren’t about trade—they were weapons. Sharp, sudden, and strategic.

When Mexico faced the threat, it wasn’t its exports under fire—it was its sovereignty. But the message was clear: crackdown on the border chaos and the fentanyl flood, or pay the price. Cooperation came swiftly. Labs were raided, borders tightened, and just like that, the tariff threat vanished under the fine print of USMCA.

The same script played out in Colombia. A flash of tariffs—no warning, no buildup—just pressure. It wasn’t about economics. It was about leverage. The U.S. sent a signal—whether about narcotics or geopolitics in Venezuela—and within hours, the hammer was raised, then quietly pulled back.

But is this strategy feasible?

The National Association of Manufacturers said in a Feb. 1 statement that while manufacturers understand the need to stop the flow of illegal drugs across the U.S. border, which Trump has stated is a main catalyst for the tariffs, such drastic measures will harm the industry. “A 25% tariff on Canada and Mexico threatens to upend the very supply chains that have made U.S. manufacturing more competitive globally,” NAM President and CEO Jay Timmons said in a statement. The ripple effects will be severe, particularly for small and medium-sized manufacturers that lack the flexibility and capital to rapidly find alternative suppliers or absorb skyrocketing energy costs.” (Source: Tariff uncertainty sparks manufacturing anxiety, especially among small firms / Manufacturing Dive)

As tariff walls rise and trade routes shift, companies scramble for safe harbors. Moving supply chains out of China and Mexico is no longer a silver bullet—especially as tariffs expand to Europe and beyond. The noose is tightening.

Turning inward to domestic suppliers seems like the patriotic play. But it comes at a cost. Higher prices. Limited capacity. And a manufacturing sector already gasping for skilled labor.

Some try to outmaneuver the rules—importing parts instead of finished goods, assembling them on U.S. soil to dodge the fee traps. It works. Until it doesn’t.

Even if demand for U.S. manufacturing roars back, a darker question looms: Who will build it? The labor force isn’t ready—not for the tech-heavy precision today’s factories demand. The machines are waiting, but the workers aren’t there.

And that may be the real bottleneck, more than any tariff or tax.

Can the Tariffs Lead to De-Dollarization?

There is much discussion about how the Trump tariffs may impact the use of the US Dollar as the main reserve currency.

Data from global payment services provider Society for Worldwide Interbank Financial Telecommunication (SWIFT) in December showed that the US Dollar, Euro, British Pound, and Chinese Yuan are the main currencies for trade settlements.

In December, the yuan trailed behind the US dollar, which had a 49 percent share of global payments. The euro, at 21.74 percent, and the pound, at 6.94 percent, were the second and third most-traded currencies during the month, while the yuan was fourth. (Source: Yuan remains fourth most active payment currency in December: SWIFT / Global Times)

Yes, other currencies are emerging as an alternative to the US Dollar in terms of use in trade settlements, but is de-dollarization imminent?

India's External Affairs Minister, Dr. Jaishankar, has an interesting take. He says that while the bilateral mechanisms of trade settlements will increase, de-dollarization is not a reality or a strategy that most countries may be working toward.

Deliberate underplaying or stating the truth?

You see, the facts still point to the power of US Dollar.

- The dollar still underpins 88% of global forex transactions

- No alternative currency yet matches the depth of US Treasury markets ($24.3T outstanding)

- 57% of global trade finance remains dollar-denominated

So what is the truth?

Trump’s tariffs won’t dethrone the dollar overnight — but they’re not benign either.

They will act as accelerants, fanning the flames of de-dollarization already burning beneath the surface. As global trade fractures and strategic blocs calcify, the world edges toward a new monetary order.

The IMF projects a 3.1% contraction in global GDP due to rising trade barriers and supply chain rewiring — not just economic cost, but geopolitical reconfiguration.

In this landscape, nations are rethinking exposure to the dollar-driven system that can weaponize tariffs and sanctions at will.

Over the next decade, the cumulative weight of fragmentation. The American currency may still sit atop the throne, but the foundations are beginning to shift.

An Interesting but Shaky Analytical Angle

There is an interesting analysis doing the rounds in the X circles that needs to be examined.

Check this entire thread out.

Trump’s new tariffs aren’t a trade tweak—they’re the first move in a full-spectrum reset.

— Tanvi Ratna (@tanvi_ratna) April 3, 2025

$9.2T in debt matures in 2025. Inflation lingers. Alliances are shifting.

One announcement just set a dozen wheels in motion.

Here’s what’s really happening—and why it matters 🧵 pic.twitter.com/yPOO1RP4hE

The lady shares some great credentials for herself:

Here's the essence of her argument:

Now, despite its appeal, this strategy is shaky and not really based on credible data or argument.

While the $9.2 trillion debt burden is real, deliberately inducing a recession to lower yields is akin to "burning the village to save it"—a risky move that could backfire if uncontrolled.

Tariffs might generate revenue but also raise costs for Americans and provoke retaliatory measures that harm U.S. exporters and jobs.

The assumption that such a strategy can be finely tuned—to create just enough market uncertainty without triggering a full-blown crisis—is overly optimistic. It presumes a level of control over market psychology and international responses that no government indeed possesses.

While the debt crisis is undeniable, deliberately inducing economic instability as a remedy could prove more damaging, forcing policymakers to navigate difficult trade-offs between fiscal sustainability and overall economic stability.

This is why it may be interesting to game-play the scenario that can unfold from here on. To further understand how things can turn out, let us turn to something used in such competitive situations—the Prisoner's Dilemma.

Trump's Tariffs and Prisoner's Dilemma Analysis

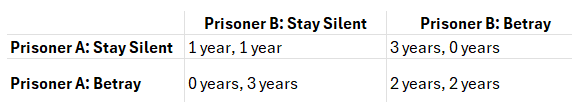

What is the Prisoner's Dilemma?

The Prisoner’s Dilemma is a classic example from game theory that illustrates why two rational actors might not cooperate, even if it is in their best collective interest.

The Setup

Two criminals are arrested and interrogated in separate rooms. They have two choices:

- Cooperate (Stay Silent)

- Defect (Betray the other)

So here is the layout of the scenario -

- If both stay silent, they get 1 year each (best collective outcome).

- If one betrays while the other stays silent, the betrayer walks free while the other gets 3 years (temptation to defect).

- If both betray, they get 2 years each (worse than cooperating but better than being the sole cooperator).

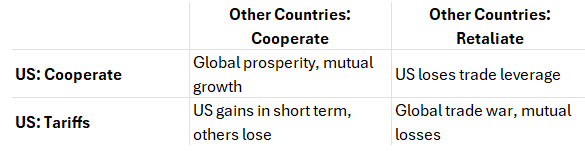

Putting this in a table its easier to understand:

It is pretty evident that the dominant strategy for each is betrayal, even though mutual cooperation leads to a better collective outcome. The dilemma for both players is that rational self-interest leads to a worse outcome.

So, using the above framework, let's illustrate this in the case of the tariff wars that the world may face now.

Players - for this analysis, let us simplify it and create the scenario of the US vs the Rest of the World, which is how it is being played out in terms of a unilateral action.

- United States

- Other Major Trading Partners (e.g., China, EU, Mexico, Canada)

Choices: What choices do the players have given the global trade structures as the tariffs are being levied?

- Cooperate (Free Trade / Minimal Tariffs)

- Defect (Impose Tariffs / Retaliate)

So how does the matrix look now?

Viewed through the Prisoner's Dilemma, the US decision to impose tariffs on China, driven by its own economic self-interest in protecting domestic industries and reducing reliance, potentially represents a move towards a potentially suboptimal "defect" strategy.

Other countries now face a choice:

- Cooperate: Absorb the tariffs and not retaliate (which could hurt them economically and politically at home).

- Defect: Impose retaliatory tariffs or barriers (hurting both parties, potentially igniting a trade war).

With the imposition of tariffs, the US has started geostrategic games.

But what could have been the fundamental motivation behind these actions? Reigning China. Why?

- Curbing China’s rise in advanced technologies (EVs, AI chips, batteries)

- Protecting domestic manufacturing jobs (lost due to Obama and then Biden's industrial policy)

- Fulfilling the promises made to domestic voters before the 2024 elections

After all, for all the sermonizing from the EU on Trump's tariff actions, the fact is that they had used this tool earlier this year against the Chinese as well!

Chinese electric vehicle makers BYD, Geely, and SAIC have challenged the EU's import tariffs at the Court of Justice of the European Union (CJEU), filings on the court's website showed on Thursday. The EU imposed tariffs on China-made EVs at the end of October after an anti-subsidy investigation, including 17.0% for BYD, 18.8% for Geely, and 35.3% for SAIC, on top of the EU's standard car import duty of 10%. (Source: "Chinese EV makers file challenges to tariffs at EU court" / Reuters)

So how will the other countries react and respond?

- China, aware that this is no longer about economics — retaliates. Quietly, for now. But the counter-punch is loading. Agriculture? Rare earths? The Belt and Road weaponized?

- Europe pretends neutrality but watches nervously. Their industries are vulnerable, and their loyalties are divided.

- Canada, Mexico, and others — caught between giants — begin recalibrating.

Everyone wants to defect. No one wants to be the sacrificial dove.

This is not a game of trust. It’s a slow spiral into fragmentation.

What we are witnessing is not just a “tariff retaliation cycle.” It is a manifestation of strategic non-cooperation — a deeper unraveling of the post-war economic consensus.

Most economists warn that trade wars make everyone poorer. But political calculations and geostrategic mistrust have their own play in how the decisions are taken.

Sometimes, Short-term wins. Long-term vision bleeds.

As the spiral deepens, economies decouple.

Trade blocs will start hardening into rival camps. Global resources—once flowing with relative efficiency—will begin to stagger across ideological fault lines.

This is not just economic inefficiency. It may very well be the beginning of a fractured world order.

So, you see, the Prisoner's Dilemma, in this context, becomes irreversible.

Because no one trusts the other. Because the stakes are too high. Because hegemony has no friends.

How will this play out in the long term? Here are some of the impacts that the new tariff wars could unleash.

- The end of Bretton Woods logic. Tariffs mean the unraveling of the post-WWII global consensus.

- The emergence of trade blocs. Think economic NATO vs BRICS+.

- The acceleration of supply chain weaponization — a world where goods and flows aren’t efficient, they’re strategic.

- And most of all — the death of the myth of interdependence.

Essentially, we are entering an era of Economic Realpolitik.

- Where policy wonks will be replaced by geostrategists in boardrooms.

- Where business decisions will factor in tariff risk, subsidy games, and supply chain allegiance.

- Where every trade route, every energy pipeline, every port becomes a piece on a chessboard no longer hidden.

We are entering an era of economic realpolitik—a world where ideals give way to power equations. The age of policy wonks is waning, replaced by geostrategists in corporate boardrooms. Business decisions are no longer just about profit margins but about tariff risks, subsidy battles, and choosing sides in fragmented supply chains.

Trade isn’t free — it’s strategic. Subsidies aren’t just incentives — they’re weapons.

Every port, pipeline, and shipping route is now a visible piece on a global chessboard, moved not for efficiency but for dominance. The illusion of a neutral market has shattered.

What remains is a new kind of warfare — waged with rules, trade deals, and economic leverage.

This is not just a shift in policy. It is a civilizational reset — one where nations protect, retaliate, and reposition in a zero-sum game of global commerce. In this game, cooperation is a weakness, and defection is a strategy.

What could this also point to?

Buried in the yellowing pages of Felix Somary’s memoir lies a forgotten tremor. A footnote in history.

It's about a railway line. But not just any railway.

It was a harbinger of something very significant unfolding.

In 1908, Somary — protégé of Carl Menger, the father of Austrian economics—was assigned a trivial task: broker a loan for a railway from Bosnia to Salonika. A line drawn through mountains and maps. Simple enough, right? What could possibly go wrong?

Well, apparently, everything did!

The route sliced through the Sanjak of Novi Bazar, an Ottoman sliver nestled between empires. Somary filed a request with the Sublime Porte — a very routine, bureaucratic, and harmless action.

But suddenly, a storm ignited.

From Moscow to Paris, diplomatic outrage erupted. The Russian-French axis didn’t just protest — they countered.

They came up with their own railway proposal, running from the Danube to the Adriatic.

Obviously, it was a geo-strategic chess move cloaked as infrastructure.

To most, this was noise. To Somary, it was a signal.

He saw the portents of war forming.

What's remarkable about Somary's insight is that it was rooted in a mathematical framework, one that would later become known as Bayesian statistics. He had, in effect, applied Bayes' theorem to the problem, starting with a hypothesis about the probability of world war, which, in the absence of any information, was weighted fifty-fifty. As incidents like the Sanjak railway emerged, they were added to the equation, increasing the odds of war.

Within six years, the Balkans would burn. Then the world. The Great War would shatter Europe’s empires.

But Somary had already seen it—hidden in a railway, written in statistics.

Because most of the time, calamities don’t announce their arrival with a bang. It's most often a mere murmur. And only those who listen to the murmurs can see the avalanche before it begins.

A state where everyone is on his/her own.

Impact and Options for India

India’s inclusion in the list of countries where the tariffs were imposed is not incidental — it’s strategic.

After all, India is no China.

It isn’t flooding U.S. markets with state-subsidized semiconductors or electric vehicles.

Yet, it runs a steady trade surplus with the United States and levies steep tariffs on foreign goods — a legacy of its protectionist past.

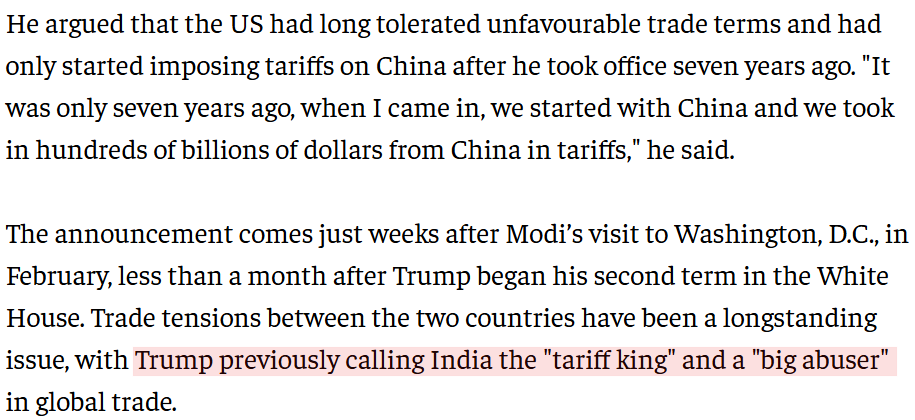

Trump once called India the “tariff king.”

That mantle comes with its own weight in Trump's second term.

Yes, this time, India wasn’t singled out — not like China, Japan, or the EU. But it wasn’t spared either.

A 10% baseline tariff quietly applies to Indian goods. It’s the velvet glove. The iron fist may follow.

Why?

For the U.S., India presents a complex duality: a source of trade friction and a crucial strategic ally.

While a tough negotiator, India is vital to the Indo-Pacific strategy of containing China. Therefore, Trump's tariffs aren't solely punitive; they are leverage.

These tariffs serve as bargaining chips, a calculated move with a clear message: open your markets or face restricted access to ours.

The U.S. seeks more than just tariff reductions on goods like motorcycles and whiskey.

It demands alignment.

For example, it may push India in other areas.

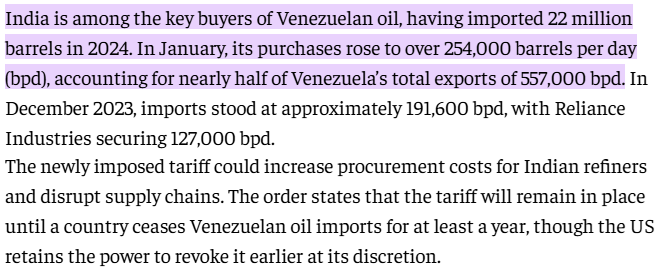

One area could be oil purchases from Iran, obviously, and even from Venezuela.

The other area could be the LNG purchases from the US by India.

India is considering a proposal to scrap import tax on U.S. liquefied natural gas (LNG) to boost purchases and help cut the trade surplus with Washington, a key irritant for President Donald Trump, four government and industry sources said. The United States is India's second biggest supplier but the two sides are looking to ramp up volumes for India's energy-hungry economy, one of the fastest growing in the world. Qatar is the top LNG supplier to India. During Prime Minister Narendra Modi's U.S. visit last month, India pledged to increase U.S. energy purchases by $10 billion to $25 billion in the near future, while both leaders agreed to target $500 billion in bilateral trade by 2030. Scrapping the import tax would make U.S. LNG more price competitive, and help trim India's trade surplus with the U.S., another government source said. The surplus totalled $45.4 billion last year. (Source: India weighs scrapping import tax on US LNG, boost purchases, sources say / Reuters)

The third area that the Trump administration would want alignment from India is the attempts to isolate China.

India could negotiate customized tariff exemptions as a reciprocal move, creating a bilateral trade channel protected from broader trade conflicts.

The options, therefore, that India has, are the following:

- Engage, without surrendering autonomy. Leverage strategic assets like defense ties, technological capabilities, and market size to gain concessions without seeming to capitulate.

- Diversify trade routes. Deepen partnerships with ASEAN, Africa, and Middle East players to balance dependence.

- Open selectively. Reduce tariffs in sectors where local industries can handle competition, but keep protections in place for vulnerable areas.

- Play the long game. India may work to project itself as an independent civilizational power with significant global influence, moving beyond transactional relationships towards strategic partnerships.

More than just affecting tariffs, this standoff will reveal whether India can effectively assert its strategic sovereignty in a world transitioning from multilateralism to a multipolar system dominated by assertive bilateralism.

Now, let us look at how the tariffs will impact globally.

The Global Impact and Changing Configurations

As is evident, the proposed “reset” through tariffs and strategic realignments is bold, unorthodox, and disruptive by design.

But with that ambition comes a heavy dose of risk and uncertainty. It’s a high-stakes gamble—one that challenges decades of economic orthodoxy and opens the door to unintended consequences.

Economic Recession or Stagflation

The most immediate threat is a global recession triggered by aggressive tariffs and geopolitical instability. This could include a U.S. recession, occurring before the intended benefits, like lower rates or reshoring jobs, are realized. If businesses cut investments due to tariff-related uncertainty and consumers reduce spending due to rising prices, the U.S. risks stagflation—low growth coupled with high inflation. This would undermine fiscal stability by increasing deficits and could quickly erode public support. The timing is critical; a downturn in 2025-26 would be politically damaging. The administration hopes for a brief, controlled slowdown to manage inflation. However, historical precedents, such as the 1970s trade wars and the 2008 financial crisis, demonstrate the difficulty of controlling negative feedback loops once they begin. Investor confidence could falter if U.S. policies are perceived as erratic, potentially leading to a risk premium on U.S. debt and higher yields, rather than the expected safe-haven effect for Treasuries. While this hasn't occurred yet, it remains a significant risk, particularly if a debt ceiling crisis coincides with these economic pressures.

Global Backlash and New Blocs

The U.S. risks pushing targeted nations into alternative alliances by simultaneously confronting multiple countries. Evidence of this is emerging, as seen in the joint naval drills by China, Russia, and Iran in March 2025, a clear signal of their united front against perceived U.S. disruption. These nations are promoting their military cooperation as a counterweight to American influence. Economically, countries affected by U.S. tariffs are exploring non-dollar trade and alternative financial systems. China has increased trade with Russia, bypassing U.S. sanctions, and the BRICS nations are discussing alternate payment systems and a reserve currency. Trump's vision of a U.S.-led order may instead result in a fractured world, potentially with a U.S.-Russia axis against a China-led coalition, or vice versa. If Trump's efforts to align with Russia fail, a strengthened Beijing-Moscow-Tehran axis could emerge, confronting a U.S. that has alienated its allies, contradicting the intended outcome and diminishing U.S. global influence.

Allies Losing Trust

Long-standing allies are deeply concerned by the "America First" approach. The erosion of U.S. alliances and institutions threatens the postwar world order. If allies feel betrayed by tariffs and security ultimatums, they may hedge their bets. Europe is pursuing strategic autonomy with an independent defense force and increased intra-EU trade. Japan and South Korea are strengthening ties in response to U.S. uncertainty and Japan is boosting its defense spending and diversifying its economic partnerships. Just as the European countries are - specifically Germany. We may be looking at a rapid decoupling of U.S. and allied strategic trajectories, with allies potentially pursuing policies contrary to U.S. interests. This would weaken the coordinated front vital in global crises and erode U.S. soft power, which is irreplaceable by tariffs. Losing the trust of allies, a key U.S. advantage over adversaries, would be a critical strategic error, specifically when it comes pushing the America agenda. When that time comes, no one will be available to back you.

Adversaries Not Bending (Strategic Stubbornness)

It's uncertain whether Russia and China will concede to Trump's demands at all. The "reverse Nixon" strategy, aiming to separate Russia from China, seemingly plausible, may not work. Putin and Xi have reaffirmed their "no limits" partnership, rejecting attempts to divide them. Russia values its strategic alignment with China and may not trust U.S. intentions. If Putin merely seeks sanctions relief without breaking from Beijing, U.S. leverage will diminish. Similarly, China may choose to resist, calculating that Trump's policies will alienate allies and trigger domestic backlash. If China weathers the storm and maintains its ties with Russia and Iran, it could emerge stronger in a fragmented world. The reset strategy risks strengthening the Sino-Russian axis, as these nations unite against U.S. pressure. We could be looking at protracted conflicts on multiple fronts.

Retaliation and Domestic Blowback

Beyond economic retaliation, unconventional responses like targeting U.S. debt are possible. China and other nations could slow or halt Treasury purchases, impacting U.S. interest rates. If the U.S. is perceived as destabilizing, investors might reduce exposure to U.S. assets, threatening the "exorbitant privilege" of easy financing. Nations could also develop alternative financial systems to bypass U.S. controlled networks. Domestically, industries like agriculture are already suffering from retaliatory tariffs. Political blowback from affected constituencies, including traditionally Republican-aligned groups, could occur. Companies are already citing tariff-related uncertainty as a factor in lowered earnings forecasts. If job losses or price increases affect key sectors, public support for Trump's policies may decline, forcing the administration to pivot or provide bailouts.

Legal and Institutional Challenges

The legal basis for sweeping tariffs and deals is uncertain. The use of Section 232 and Section 301 authorities faces potential court and WTO challenges. While the U.S. can ignore WTO rulings, this undermines the global trading system. Domestically, Congress might attempt to reclaim tariff powers. Ethical and legal questions arise from linking economic policy with DOJ investigations. The complex implementation of tariff rules and bilateral terms creates potential for confusion and corruption.

Resetting the Global Order – Opportunity or Vacuum

The outcome of Trump's global reset is uncertain. His attempt to dismantle the existing order risks creating a power vacuum. A shift to a multipolar world could lead to increased conflict in regions like the Middle East, Eastern Europe, and Africa. Nations are hedging and diversifying partnerships to mitigate U.S. unpredictability.

China's growing influence, evidenced by its role in the Saudi-Iran détente, highlights the potential for other powers to fill any void left by the U.S. The key question is whether the U.S. can manage a peaceful transition or if the process will result in chaos.

The Next Thousand Years...

In essence, attempting to “reset” the global order is a gamble with high uncertainty. The flaw might be underestimating the depth of existing alliances and rivalries. The post-1945 order was not just a whim; it was built on hard lessons and trust over decades. Changing it so abruptly risks unintended consequences.

Just like Mehmed II's tariffs on traders going from Europe to Asia and vice-versa set in motion events that changed almost every continent and established today's global order, Trump's tariffs on those exporting to the US may set in motion events that will rule the world in the next at least one or two thousand years.

Comments ()